FTUK’s appeal lies in its offer of capital and its focus on disciplined trading, attracting those who believe in their skills but lack the funds to trade big. However, the reality of dealing with FTUK is more complicated than the enticing promise of risk-free trading with someone else’s money. Let’s break down how FTUK actually works, what traders can expect, and why scepticism might be warranted.

How FTUK Operates

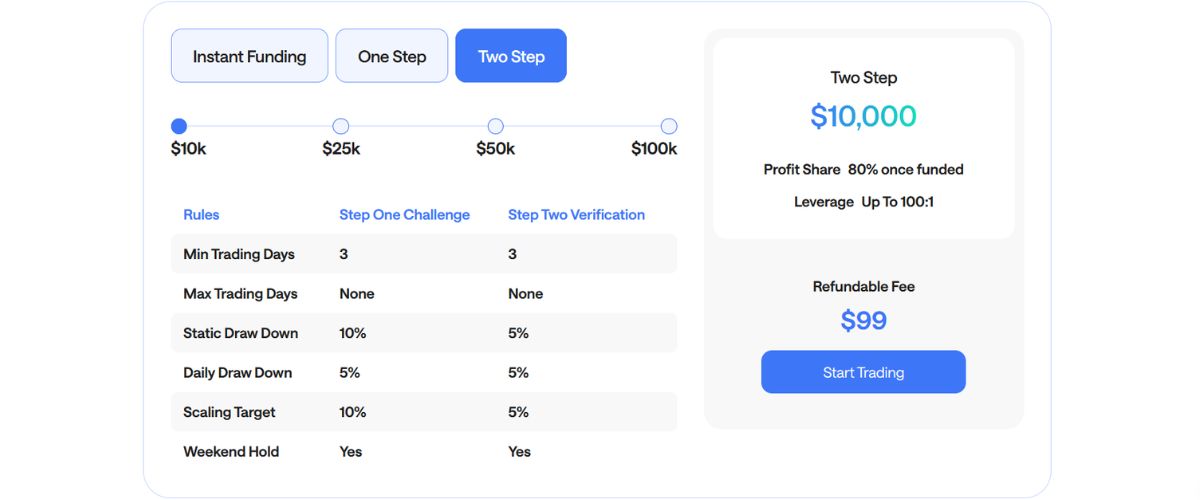

The process of getting funded by FTUK starts with a multi-phase evaluation. Initially, traders must demonstrate their abilities by trading on a forex practice account, hitting strict profit targets within a set period. During this phase, traders face rigid drawdown limits—a cap on the amount of losses they can incur. Meeting these conditions is crucial because even a small slip-up can mean the end of your evaluation journey.

FTUK’s evaluation has two stages. The first stage demands a higher profit target within a limited timeframe, while the second phase offers slightly lower targets but maintains tight risk controls. Passing both stages is the only way to access FTUK’s capital. Once funded, you’re expected to continue trading with disciplined risk management, as the strict rules do not disappear. Traders have to be nearly flawless to avoid breaking these restrictions, which can result in immediate account termination.

What to Expect as a Funded Trader

Achieving funded status with FTUK allows you to trade using a significant amount of capital, which could lead to substantial profits if you manage to navigate their rules successfully. FTUK promises a competitive profit split, letting traders keep a large portion of their gains, but the conditions remain challenging. One wrong move can still result in losing your funded account, even after passing the evaluation.

Traders have also reported mixed experiences regarding payouts. While some have had smooth experiences receiving their profits, others have faced delays and frustrating communication issues with FTUK’s support team. This inconsistency raises concerns about the firm’s reliability and its true level of commitment to supporting profitable traders.