Unregulated Broker, Be Cautious When Trading with FXCentrum

In a space where new brokers appear by the week, FXCentrum stands out—if nothing else, then at least for its bold promises and aggressive bonus structures. Founded in 2019, the company has been trying to carve out a space for itself among retail forex and CFD traders. But is it actually worth your attention, or is it another offshore operation that’s more flash than substance?

Only Trade with Regulated and Reputable Brokers

| List of Regulated Forex Brokers | List of Regulated CFD Brokers |

What FXCentrum Has to Offer

Let’s break down exactly what FXCentrum has to offer—from platforms and accounts to trading conditions, regulation, and user experiences.

Company Overview and Regulation

FXCentrum is operated by WTG Ltd., a company registered in the Seychelles. The broker is licensed by the Seychelles Financial Services Authority (FSA). Now, while that may sound reassuring, let’s not pretend it offers the same level of investor protection you’d get from regulators in the UK, Australia, or the EU. Offshore regulation usually means fewer compliance requirements, which can be a red flag for more risk-averse traders.

In other words, while they are technically regulated, you’re not going to get the same safety net here that you’d find with a more tightly controlled broker. So, if client fund security and legal recourse are high on your priority list, this may already be a tough sell.

Platform: Meet FXC Trader

FXCentrum doesn’t offer MetaTrader 4 or MetaTrader 5—something that might immediately disqualify them in the eyes of seasoned traders. Instead, they push their own proprietary platform, FXC Trader, which is available on desktop, web, and mobile.

To be fair, the platform is reasonably modern. The layout is clean, it supports basic charting, and placing trades is straightforward. But it lacks the flexibility, depth, and long-term track record that come with MT4 and MT5. There are fewer indicators, no Expert Advisors, and limited options when it comes to customising your trading environment.

For beginners, it might do the job. But for anyone who relies on advanced analytics or algorithmic trading, it’s probably going to feel restrictive.

Account Types and What You Can Trade

FXCentrum has structured its account offerings around bonus incentives and leverage, rather than any particularly innovative trading features. Here’s a quick breakdown:

- Floating Bonus Account – 50% bonus on all deposits, no cap. Minimum deposit is $10. Leverage up to 1:1000. Scalping isn’t allowed on this one.

- Margin Bonus Account – 100% bonus on deposits up to $100,000. Same $10 minimum deposit and up to 1:1000 leverage.

- Scalping Margin Bonus Account – As the name implies, this one’s for scalpers. You’ll get a 50% deposit bonus and access to high leverage (also up to 1:1000), but with a minimum deposit of $1,000.

There’s a clear strategy here: lure traders in with low barriers to entry and high leverage. Whether that works in the trader’s favor depends on how disciplined you are with risk.

As for tradable instruments, there’s a lot on the menu. FXCentrum claims access to over 2,200 assets, which includes:

- More than 40 forex pairs (majors, minors, exotics)

- Commodities like gold, silver, oil, and agricultural futures

- 30+ global stock indices

- CFDs on 100+ US shares and a handful of ETFs

- Popular cryptocurrencies including Bitcoin and Ethereum

Plenty of variety for traders who like to jump between markets—but without platform support like MT5, managing multiple asset classes might not be as smooth as it sounds.

Fees, Spreads & Leverage

Let’s talk money. FXCentrum’s pricing is fairly competitive—at least on paper. Forex spreads start as low as 0.3 pips on major pairs under certain account types, and most trading is commission-free unless you opt for their “raw spread” setup.

They make a big deal out of their zero-commission structure, which sounds appealing, but you’ll want to watch the spreads carefully. Like many brokers that skip commission fees, the markup gets baked into the spread.

Leverage is generous across the board—up to 1:1000. That’s massive, and while it opens the door to significant gains, it can just as easily wipe out an account if you’re not managing risk tightly. This level of leverage won’t be available in most regulated jurisdictions for good reason.

So yes, the costs look attractive—but only if you’re confident in your strategy and know how to keep your downside in check.

Funding and Withdrawals

FXCentrum supports a decent selection of funding methods. You can deposit and withdraw using traditional bank transfers, credit and debit cards, and a handful of e-wallets including AstroPay and Perfect Money. They also support crypto payments like Bitcoin and Tether (USDT), which is a nice touch for traders who prefer blockchain-based transactions.

Minimum deposits are as low as $10 for most accounts, which makes it accessible for casual or first-time traders. They claim not to charge deposit fees, and most withdrawal methods are processed without much delay. That said, like any broker, processing times and transaction limits can vary depending on the payment provider and jurisdiction.

Support and Educational Content

Customer support is available via live chat, email, and phone. Live chat is generally responsive during market hours, though don’t expect 24/7 service. The support team is polite and generally helpful with basic queries, though more complex issues might take longer to resolve.

FXCentrum also offers some educational content, including trading guides, platform walkthroughs, webinars, and e-books. The material is solid for beginners—particularly those trying to grasp the basics of forex and CFD trading—but there’s nothing here that stands out as cutting-edge or particularly advanced. If you’re new, it’s a decent starting point. If you’re experienced, you’ve probably seen better.

FXCentrum Pros and Cons

Pros

Cons

Reviews from the Web: What Are Traders Saying?

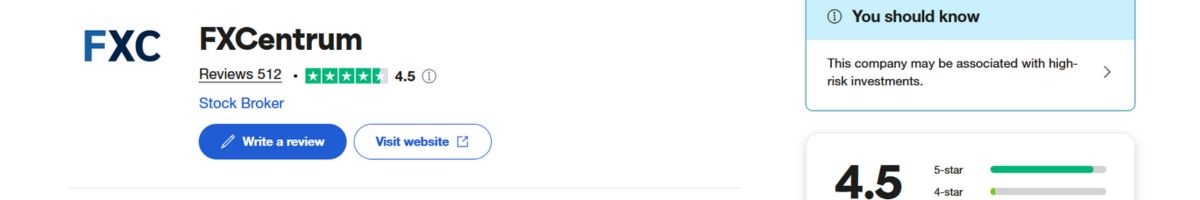

Community feedback is mixed. Some users appreciate the platform’s simplicity and the bonus structure, especially given the low deposit requirements. Others are less impressed, citing concerns over the lack of regulation from a well-known authority and the absence of MT4/MT5.

A few users have reported delays in withdrawals or unclear fee breakdowns, although this doesn’t appear to be a widespread issue. Still, it’s something worth considering if transparency and fund security are non-negotiables for you.

FXCentrum FAQs

Final Verdict: Is FXCentrum Worth the Risk?

FXCentrum has positioned itself as a broker that offers accessibility, high leverage, and bonus-driven account incentives. It’s an appealing proposition for newer traders or those looking to trade with smaller amounts of capital. However, its offshore regulation, lack of MT4/MT5, and focus on bonuses over long-term features make it less attractive to serious or professional traders.

If you’re comfortable with higher risk and you’re mainly looking to dip a toe into multi-asset trading, FXCentrum might be worth exploring. But for those seeking strong regulatory oversight, platform flexibility, and deeper market tools, there are more established names to consider.