Unregulated Broker, Be Cautious When Trading with FXPrimus

FXPrimus is an online brokerage established in 2009, offering traders access to multiple financial markets, including forex, commodities, indices, equities, and cryptocurrencies. While the broker markets itself as a provider of a safe and effective trading environment, careful analysis highlights significant concerns, primarily related to regulatory oversight and security. Traders considering FXPrimus should understand both its advantages and potential risks clearly before committing funds.

Only Trade with Regulated and Reputable Brokers

| Best Regulated Forex Brokers | Best Regulated CFD Brokers |

What FXPrimus Has to Offer

Benefits of trading with FXPRIMUS

Regulation and Security

Regulatory security plays a critical role in selecting a brokerage, and FXPrimus raises substantial concerns in this regard. FXPrimus is regulated by the Vanuatu Financial Services Commission (VFSC), an authority known for its notably lenient oversight and minimal enforcement capabilities, which significantly undermines investor protections. The brokerage is not regulated by highly respected agencies such as the UK’s Financial Conduct Authority (FCA) or Australia’s Australian Securities and Investments Commission (ASIC), creating doubts about the reliability of its compliance standards. While FXPrimus asserts that it provides various security measures like segregated client accounts and negative balance protection, the effectiveness of these measures remains uncertain in the absence of robust regulatory support.

Trading Platforms

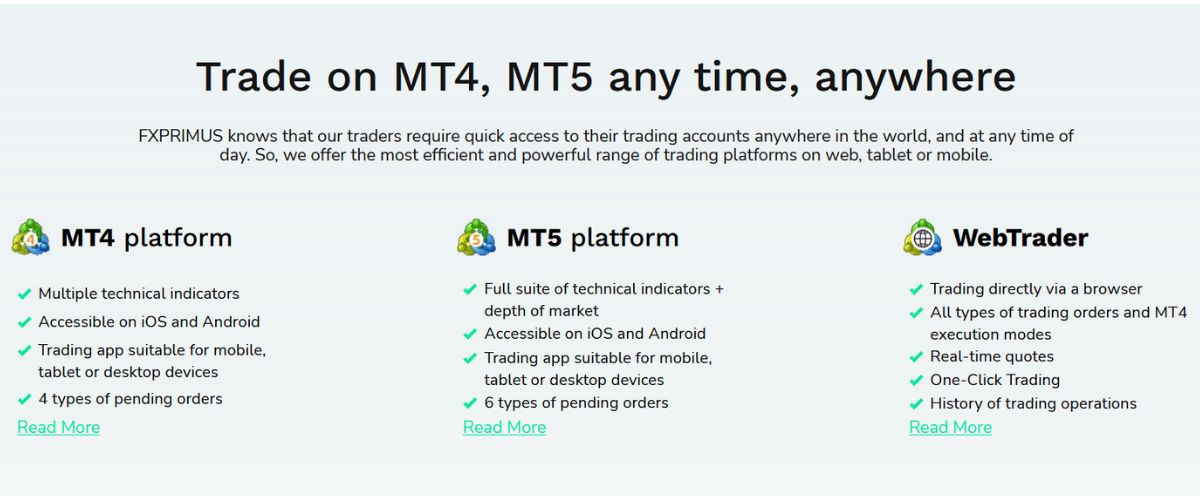

FXPrimus provides traders with access to several popular trading platforms:

FXPrimus trading platforms and their features

However, FXPrimus does not offer proprietary platforms or significant enhancements beyond standard platform functionalities, limiting differentiation.

Account Types

FXPrimus offers three main account options, each differing in spreads, commissions, and deposit requirements:

Trading Instruments

FXPrimus provides access to various trading instruments, although its selection may seem limited compared to competitors:

FXPrimus Pros and Cons

Pros

Cons

Reviews from the Web: What Traders Are Saying About FXPrimus

What people say about FXPrimus on Trustpilot

Robert Samardžija: “I dont like small leverage on crypto, i use 1:1000 leverage account but cant risk with stop loss 5% of my portfolio on single trade which i ussualy do.”

Melihates: “Likewise, I have not been able to withdraw money for 30 days. I am in a difficult situation and I am a victim. I cannot get any response from FxPrimus company. We will complain about all licenses.”

akash14: “I want to warn everyone about usage of this broker about their bogus bonus and trade stopout rules. Fxprimus gives 100% bonus for deposits above 500$ which is a bonus and a trap to make you loose money. Its utter useless because it does not support, equity nor it supports margin. This bonus is just present to show you higher equity and totally useless. They removed bonus from my account as my trades were negative and closed all my trades including fully hedged positions leaving me with 29$ balance after a 512$ deposit balance and 512$(useless bonus) they offered me. Below are the screenshots of them closing all my trades in a fraction of second stating i got stopped out. BE CAREFUL with these crooks.”

FXPrimus FAQs

Final Verdict: Is FXPrimus Worth the Risk?

FXPrimus presents itself as a viable brokerage option by offering competitive spreads, attractive trading conditions, and popular trading platforms such as MT4, MT5, and cTrader. Additionally, the availability of copy trading services and regular promotional bonuses may appeal to certain types of traders, particularly beginners or those looking to supplement their trading capital.

However, significant issues surrounding its regulatory framework cannot be ignored. The broker operates under VFSC regulation, which is significantly less rigorous compared to well-established regulatory bodies such as the FCA or ASIC. Furthermore, the repeated reports of customer dissatisfaction related to withdrawals and the effectiveness of customer support services further amplify concerns regarding reliability and trustworthiness.

Ultimately, traders—especially those new to trading or those cautious about financial security—are strongly advised to weigh the attractive features offered by FXPrimus against these critical risks. Considering the potential implications of limited regulatory protection and questionable operational transparency, traders might find better peace of mind and security with brokers offering stronger regulatory backing and more consistently positive client feedback.