In a market overflowing with trading platforms and broker options, Fxview has quietly built a reputation as a cost-effective and reliable option for retail traders. Founded in 2017, this broker caters to clients worldwide with a focus on low-cost trading, solid platform support, and full regulatory transparency. If you’re a trader who cares about pricing structure, asset diversity, and overall execution quality, Fxview is worth a closer look.

Only Trade with Regulated and Reputable Brokers

| Top Forex Brokers | Top CFD Brokers |

What Fxview Has to Offer

Regulation and Safety

Fxview operates under a group structure regulated by multiple authorities, which provides a decent level of client protection and adds credibility to its brand.

Trading Platforms

Fxview offers three trading platforms, each catering to different types of traders. All are accessible via desktop, web, and mobile — giving users flexibility in how and where they trade:

Account Types

Fxview keeps things relatively straightforward when it comes to accounts — no over-complication, just a few options designed around commission and spread preferences:

Trader’s Toolbox and Additional Tools

Fxview goes beyond the basics by offering a suite of extra tools that genuinely add value:

Fees and Spreads

Fxview’s pricing structure is one of its biggest selling points:

There are no hidden markups or obscure fee structures, which is refreshing in a market where some brokers make you dig to understand what you’re really paying.

Deposit and Withdrawal Options

Fxview supports a wide range of funding options that make it accessible regardless of your location or preferred method:

One of the best things here — Fxview doesn’t charge any internal fees for deposits or withdrawals. Just be aware of potential third-party charges (like your bank or wallet provider).

Tradable Instruments

Fxview offers a healthy range of assets — not the largest in the industry, but definitely enough for most retail traders to diversify.

Fxview Pros and Cons

Pros

Cons

Fxview’s Reviews from the Web

BabyPips Mixed Discussions: The forum has seen varied opinions about Fxview. While some members are optimistic about the broker’s offerings, others have expressed skepticism. One member pointed out potential promotional posts, suggesting, “WARNING: Fxview seems to be paying people to make fake positive posts about them.”

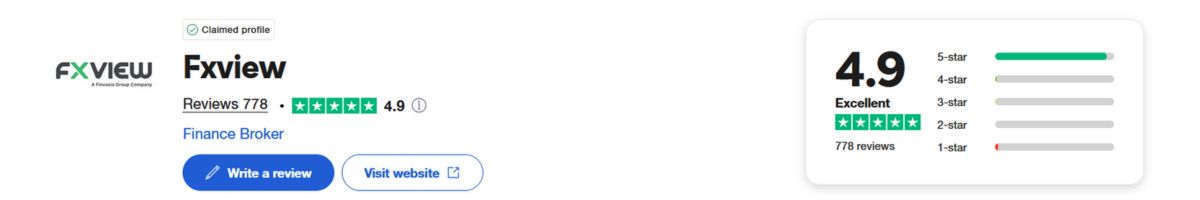

Trustpilot Reviews: A Bit Too Perfect? Fxview holds an impressive rating on Trustpilot, with overwhelmingly positive reviews — almost too positive. Many are short, generic, and posted close together, which raises some questions about authenticity. While this doesn’t prove anything shady, it’s a reminder that platforms like Trustpilot can be curated and shouldn’t be the only source you rely on when evaluating a broker.

Final Verdict: Is Fxview the Right Broker for You?

Fxview has quietly built a strong case for itself as a low-cost, high-functionality broker — without the marketing flash you often see from less capable competitors. With tight spreads, highly competitive commission structures, and full access to industry-standard platforms like MT4 and MT5 (plus ActTrader for those who want more flexibility), the infrastructure is solid. Add in strong regulation, crypto-friendly funding, and genuinely useful trading tools like the Trader’s Toolbox, and you’re looking at a platform that caters well to both new and experienced traders.

That said, it’s not for everyone. If your strategy involves niche stocks, a wide array of altcoins, or you need hand-holding through your first trades, Fxview might feel limited. But for the self-sufficient trader who values execution quality, pricing transparency, and the freedom to trade across global markets without overpaying — Fxview is a smart, no-nonsense choice.