Unregulated Broker, Be Cautious When Trading with Hankotrade

Hankotrade, established in 2019, is a relatively new player in the online trading world that has garnered attention for its high leverage, low spreads, and straightforward approach to trading. Offering access to forex, cryptocurrencies, indices, and commodities, Hankotrade has positioned itself as an attractive option for traders looking for flexibility and high returns. However, it’s crucial to approach Hankotrade with a sense of caution, as it operates without regulation from any recognized financial authority.

Only Trade with Regulated and Reputable Brokers

| Top Forex Brokers and Platforms | Top CFD Brokers Reviewed |

The lack of regulatory oversight means that traders’ funds aren’t protected by financial watchdogs, leaving them vulnerable if something goes wrong. Despite this, Hankotrade has gained popularity, particularly among high-risk traders, due to its tempting leverage options and relatively low costs. But do these features make up for the potential risks involved in trading with an unregulated broker? Let’s break down what Hankotrade offers and whether it’s worth considering.

What Sets Hankotrade Apart

One of the standout features of Hankotrade is its remarkably high leverage, going up to 1:500. This level of leverage can be incredibly appealing to traders who want to maximize their market exposure with minimal capital. However, high leverage can be a double-edged sword, amplifying losses just as much as it can boost profits. This feature alone makes Hankotrade more suitable for experienced traders who understand the risks involved.

Another factor that distinguishes Hankotrade is its focus on low-cost trading. The broker advertises tight spreads, starting from 0.0 pips on its Raw ECN account, making it a potentially cost-effective choice for traders who prioritize low trading costs. Additionally, Hankotrade offers cryptocurrency deposits, allowing traders to fund their accounts using Bitcoin and other digital currencies, which can be convenient for those who prefer crypto over traditional banking methods.

Unlike many other brokers that operate on a large scale, Hankotrade maintains a smaller, more agile operation, which they claim allows them to offer more personalized service and better trading conditions. However, this smaller scale also means they might not have the same level of infrastructure or resources as more established brokers, which can be a concern for those looking for reliability and stability.

What Hankotrade Brings to the Table

Trading Platform: Hankotrade offers a single proprietary trading platform known as HankoX. This browser-based platform provides a straightforward trading experience with essential features such as basic charting tools, various order types, and access to a decent range of technical indicators. While HankoX is user-friendly and accessible without any downloads, it lacks the advanced functionalities and customization options found in industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This could be a drawback for more experienced traders who rely on sophisticated analysis tools or prefer a platform with broader capabilities.

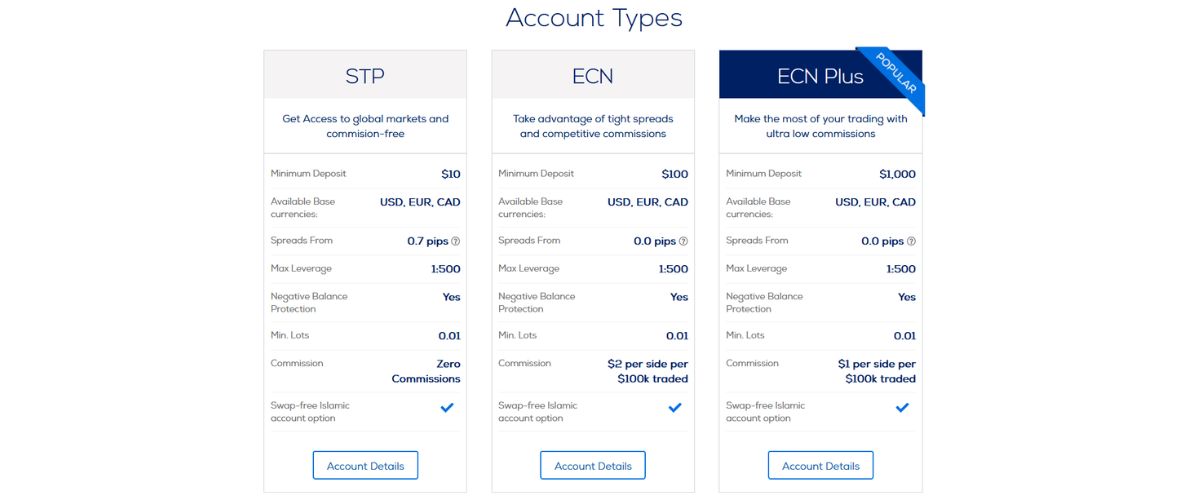

Account Types: Hankotrade provides four main account types tailored to different trading needs. The STP Account is best suited for beginners, offering no commission charges but wider spreads starting from 1.2 pips, which can lead to higher trading costs over time. This makes it more suitable for casual traders who want a straightforward fee structure without worrying about per-trade commissions.

For more experienced traders, the ECN Account offers tighter spreads starting from 0.0 pips but comes with a commission of $2 per lot per side, balancing competitive spreads with a manageable fee. The ECN Plus Account is the premium choice, designed for professional or high-volume traders, featuring the same tight spreads from 0.0 pips with a reduced commission of $1 per lot per side. Both ECN accounts provide better trading conditions but require higher deposits. Additionally, Hankotrade offers an Islamic Account option across all account types, providing swap-free trading for traders following Sharia law, making it a suitable option for those who need an interest-free trading environment.

Range of Instruments: Hankotrade offers access to a variety of trading instruments, including over 50 forex pairs, multiple cryptocurrencies, indices, and commodities like gold and oil. This range allows traders to diversify their portfolios, which is essential for managing risk and taking advantage of different market opportunities. However, the selection isn’t as extensive as what some larger brokers offer, which may be a limiting factor for traders who want access to a broader range of assets.

Fees and Spreads: One of Hankotrade’s main selling points is its low-cost trading environment. The spreads on the ECN and ECN Plus accounts are competitive, starting from 0.0 pips, and the commission rates are reasonable compared to other brokers. However, traders using the STP Account may find that the wider spreads increase their overall trading costs. While the advertised fees are transparent, it’s always important to monitor your costs, as market conditions can lead to wider spreads, especially during periods of high volatility.

Deposit and Withdrawal Options: Hankotrade only accepts cryptocurrency deposits, allowing traders to fund their accounts using Bitcoin, Ethereum, and other popular digital currencies. While this approach caters to the growing preference for crypto transactions and ensures deposits are processed quickly, withdrawals have been a point of concern for many users.

Customer Support and Educational Resources: Hankotrade offers 24/5 customer support via live chat, email, and phone. While the response times are generally acceptable, the quality of support is inconsistent, with some users praising their helpfulness while others report receiving vague or unhelpful responses. The broker’s educational resources are limited, with only a handful of basic tutorials and trading guides available. For beginners looking to learn and develop their trading skills, this lack of comprehensive educational materials can be a significant drawback.

Hankotrade Pros and Cons

Pros

Cons

Reviews from Forums and External Sources

User feedback about Hankotrade on various trading forums and review websites is mixed. On platforms like TrustPilot, Hankotrade has received an excellent rating, with many traders appreciating the low spreads, high leverage, but the lack of MT4 and MT5 puts some traders off. However, the most frequent complaints relate to transfer methods, inconsistent customer service, and the lack of regulation.

In trading communities such as Forex Peace Army, traders echo similar sentiments. Some users highlight the broker’s attractive trading conditions, but the unregulated status and reports of withdrawal issues remain significant concerns.

Hankotrade FAQs

Hankotrade – Final Verdict

Hankotrade aims to attract traders with its high leverage, competitive spreads, and crypto-friendly deposit options. The availability of its proprietary HankoX platform and the variety of account types, including an Islamic option, shows that the broker is attempting to cater to a diverse range of traders. However, the absence of regulation, lack of a more advanced trading platform like MT4/MT5, and frequent reports of withdrawal delays raise significant concerns about its reliability and safety.

For traders comfortable with the risks associated with an unregulated broker and those who prefer dealing in cryptocurrencies, Hankotrade may be an option worth exploring. However, those who prioritize security, transparency, and a more comprehensive trading experience might find better alternatives with brokers that offer regulation, advanced trading platforms, and more efficient withdrawal processes. Overall, Hankotrade could work for certain risk-tolerant traders, but it’s essential to weigh the potential drawbacks before committing to this broker.