Unregulated Broker, Be Cautious When Trading with IFC Markets

Established in 2006, IFC Markets is an online broker that offers access to various financial markets, including Forex, commodities, indices, stocks, ETFs, and cryptocurrencies. Despite its broad range of services, one of the most significant concerns surrounding IFC Markets is its lack of regulation by any top-tier financial authority. This raises serious questions about its credibility and security. Traders should exercise caution when dealing with IFC Markets, as the absence of strong oversight means weaker investor protection and potential risks.

Only Trade with Regulated and Reputable Brokers

| Regulated and Reliable Forex Brokers | Regulated and Reliable CFD Brokers |

What IFC Markets Has to Offer

IFC Markets features and why trade with the broker

Regulation and Security

It is essential to emphasize that IFC Markets is not regulated by any major financial authority such as the FCA or ASIC. Instead, it operates under the British Virgin Islands Financial Services Commission (BVI FSC). These regulatory bodies do not offer the same level of protection as globally recognised regulators. The lack of proper oversight allows IFC Markets to offer high leverage levels, which, while appealing to some traders, significantly increases exposure to risk. Traders should be extremely cautious before committing funds to this broker.

Trading Platforms

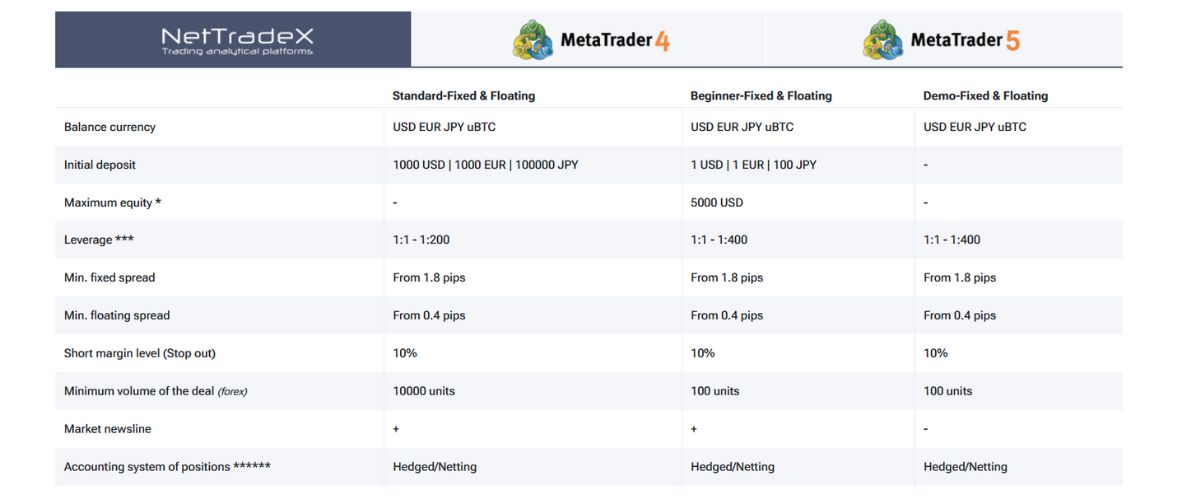

IFC Markets offers three main trading platforms, each with unique features and benefits:

IFC Markets trading platforms and their features

While these platforms offer several features, the broker’s regulatory shortcomings remain a significant concern.

Account Types

IFC Markets provides multiple account types, but traders should weigh the potential risks before opening an account:

Trading Instruments

IFC Markets offers over 650 trading instruments across various asset classes:

IFC Markets Pros and Cons

Pros

Cons

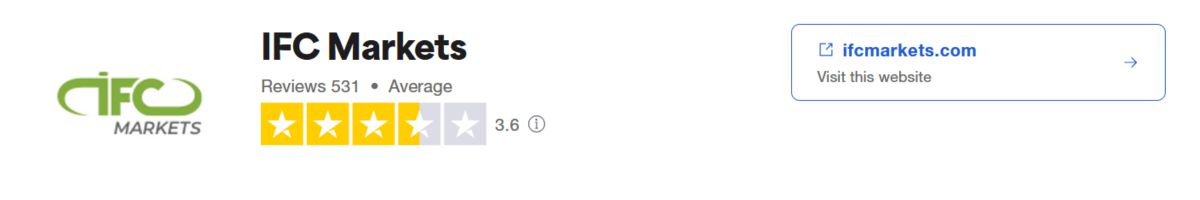

Reviews from the Web: What Traders Are Saying About IFC Markets

What traders have to say about IFC Markets on Trustpilot

Good support but high spreads: “IFC Markets offers good customer support, which I appreciate. However, the spreads on some of the most volatile currency pairs, such as GBP pairs, are excessively high. This makes trading in those pairs less profitable and harder to manage risk effectively. Reducing these spreads would greatly enhance the trading experience and make IFC Markets a more competitive option.”

Why privately change the leverage of customers?: “I want to know why you changed the client’s leverage without authorization. I traded rice in August last year, and you changed the leverage from 1:200 to 1:50 without authorization, causing me to sell out. I had no prior knowledge of the change in leverage, and you did not notify me at all. This is very strange and completely incomprehensible. I hope to receive your explanation.”

Claims to trade in currencies they don’t: “Claims to trade in currencies they dont support, and on top of that takes commisions for opening a account while withdrawing. Because I didnt do a trade. $7 gone on top of that $5 dollar withdrawal money. Thats 13% of my $100 to commisions and fees.”

IFC Markets FAQs

Final Verdict: Is IFC Markets Worth the Risk?

While IFC Markets provides multiple trading platforms, a wide range of instruments, and high leverage, its lack of regulation by any major financial authority raises serious concerns. The absence of strict oversight creates potential risks related to fund security, transparency, and dispute resolution. Traders seeking a safe and reliable broker should consider alternatives regulated by reputable authorities such as the FCA, or ASIC. Proceed with caution if considering IFC Markets, as a lack of strong regulatory backing and high spreads remain significant drawbacks.