Kortana describes itself as the ‘leader in HFT-friendly simulated funding challenges. Unlike a straight broker, where you trade using your own capital on open markets, Kortana provides a simulated environment for traders to trade FX markets. However, trade successfully and you have the opportunity to benefit from a 100% profit share on your trades – without risking your own capital in the forex markets.

Traders qualify through challenges for simulated funding from Kortana. Kortana then, at its own discretion, implements trades with its own private capital, while using trading data from its users to help shape its internal trading algorithms. This allows Kortana to pay out to traders on a risk-free basis – provided they’ve stuck to the rules, and they’re trading in profit.

As such, it’s not a broker. Users are required to pay to use the service, but it’s not a capital deposit like with a regular broker. But it is a service with some interesting opportunities for more experienced FX traders, especially with the promise of a 100% profit share down the line.

Kortana Information

Trading Markets at Kortana

Kortana gives qualifying traders access to simulated funds, trading on a demo account. Unlike some forex demo accounts, Kortana’s simulated trading uses real market liquidity, to provide the most accurate simulation possible. There is no opportunity to deposit your own money into Kortana, though there is a fee of $149 to register. Once you pass an initial challenge to get funded with demo funds, you are able to begin trading freely across a range of forex markets, as you normally would.

There are opportunities here for experienced traders to copy trade into their Kortana account, providing a secondary opportunity for earning real money. Money is paid out from Kortana’s own trading, which is informed by the trading of its users and its algorithm. Kortana FX relies on the ‘wisdom of the crowd’, pooling together the knowledge and trading instincts of its user base to shape its own real-money investment strategy.

The trading dashboard is simple to understand and follow, especially for FX traders with a bit of experience. Support for MetaTrader is a bonus here too, allowing you to trade through a familiar platform.

Kortana User Interface, Charting Tools and Order Execution

Kortana isn’t a broker, so it doesn’t offer up the same lineup of services you’d expect from a leading FX brokerage service. However, there is a user-friendly interface in the Kortana dashboard, where you can track your trades, delve deeper into analysis of individual positions, and make decisions in an aesthetically-pleasing, ease to use trading window.

Kortana has support for a variety of trading platforms if you prefer, including DXTrade and cTrader, MT4/5. It is expected that they will also offer Trade Locker in the coming months, to give traders more options on how they want to access the markets.

Remember throughout that you are trading demo funds only and paying for the privilege. The 100% profit share comes in after 4 successful withdrawals from your account, which are paid depending on the profitability of your simulated trading.

Kortana Mobile Apps

There are no mobile apps for Kortana, as you would expect from a broker. Instead, this is a web-based service, where you login to your account to place your simulated trades – with up to a maximum 7% return available on successful trading.

It is still possible to access your trades and manage your account by mobile. It’s simply a case of logging in via your phone’s browser, which will allow you to manage your trades in the usual way. If you are using an alternative trading platform, you may also be able to access this directly via your mobile to manage your trades and execute trading decisions.

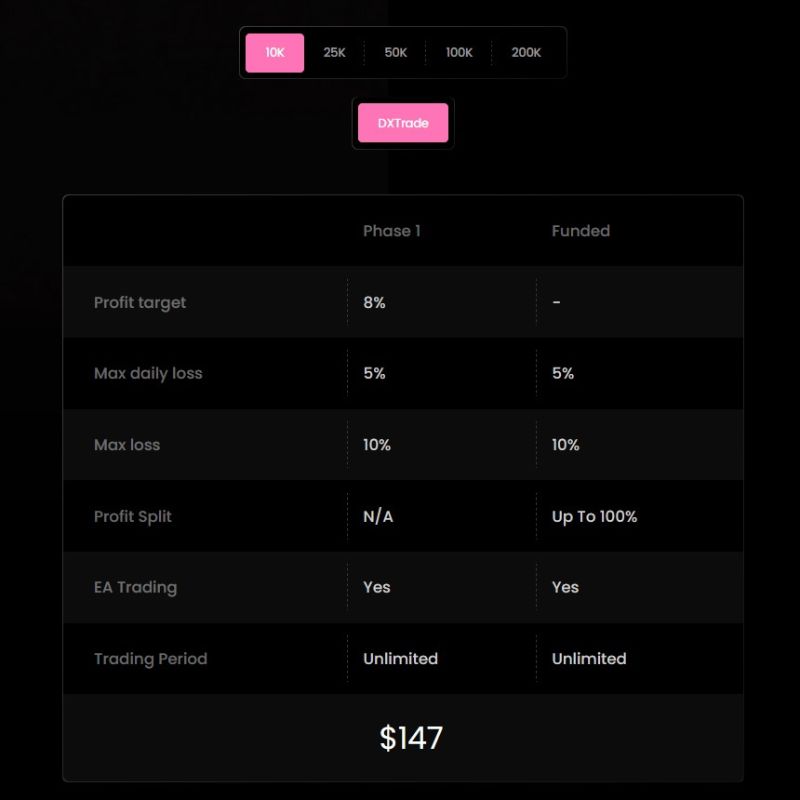

Accounts and Fees

Kortana works a little differently to regular brokers, so there are no trading fees or equivalent when you’re using the platform. There is a payment to get involved, starting at $147 for $10k in simulated funding. Here, you’re required to meet a profit target of 8%, with a maximum loss of 10% and a maximum daily loss of 5% in phase 1. Pass this, and you’re eligible to receive up to a 100% share on your profits.

At the higher level, it costs $999 to enter with a simulated account holding $200k. The same targets apply, but there’s potential to earn a greater amount on your payouts, on account of the larger balance.

kortana details, fees, payouts, and rules

Deposits and Withdrawals

There is no deposit and withdrawal process in the conventional sense. Entry to their simulated trading programmes comes at a cost ranging from $147-$999, depending on the level of funding you want to choose for your account. This is paid directly to KortanaFX, rather than deposited to your account, as with a traditional broker.

Instead of withdrawals, there are payouts for qualifying users. These are made at a percentage of your trading profits, up to 100%, depending on Kortana making money from your trading decisions and data. Kortana has paid out over $10 million to traders to date through this mechanism, which is the incentive to get involved in simulated trading on the KortanaFX platform.

It is important to be aware that some users have complained of being unfairly banned ahead of receiving a payout. As such, we’d recommend doing your own due diligence, reading the experiences of others, and taking care to stick to the programme terms and conditions to avoid running into difficulties.

Trust and Reputation

Trust in Kortana FX is harder to measure than normal. This is not a regulated broker, so there’s no financial body overseeing its operations. Instead, this is a private company based in Dubai, so there is naturally a risk that you are not dealing in a financially regulated environment. That said, you are not actually trading financial markets either, but instead buying the chance to trade simulated funds that could ultimately deliver a payout when you trade profitably.

While many users are certain Kortana pays out and have reported receiving their own payouts from the programme, there is some commentary online suggesting that Kortana is harsh in its application of terms and conditions. As such, we recommend doing your own further reading around Kortana before deciding if it’s right for you.

Pros

Cons

Kortana FAQs

Kortana – The Verdict

Kortana is not a broker and doesn’t claim to be. So, to determine a verdict on the same basis would be difficult. As a service, it sits in an interesting corner of the FX trading market, and will certainly have appeal for some traders.

For the small up-front payment and no capital down, promises of 100% payouts for the highest performing set of traders really do give this a strong appeal. But it’s worth considering that many users are upset about not receiving payouts they felt they were due, often as a result of an apparent breach of the terms and conditions.

Kortana is a service you should consider trying out if you’re an experienced trader, you’re already trading your own capital, and you do your homework – reading everything you can about Kortana, including their own terms and conditions. If you still feel like it’s a good fit for your trading, it can be a good way to pick up extra payouts for your trading skills.

With over $10 million already paid out to successful traders who have signed up to their simulated trading programmes, it’s definitely not a platform you should write off out of hand.