What is Nova Funding?

How Does Nova Funding Work?

The operational model of Nova Funding is similar to many other prop firms in the forex industry. Prospective traders go through an evaluation process that tests their trading skills and discipline. This process usually involves a simulated forex trading account where the trader must meet specific profit targets and adhere to predefined rules regarding drawdowns and risk management. If the trader successfully passes this evaluation, they are then granted access to a funded account.

The Evaluation Process

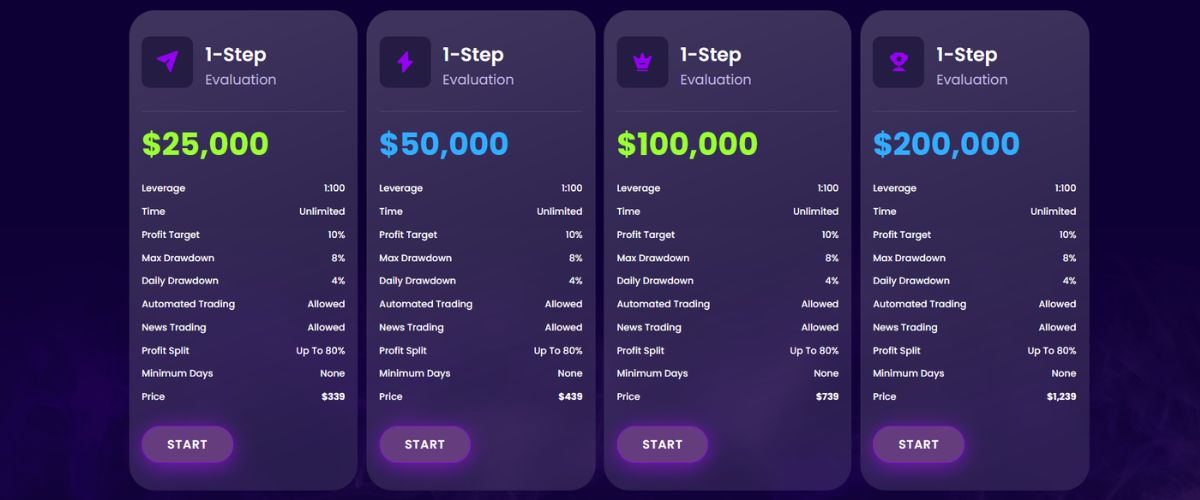

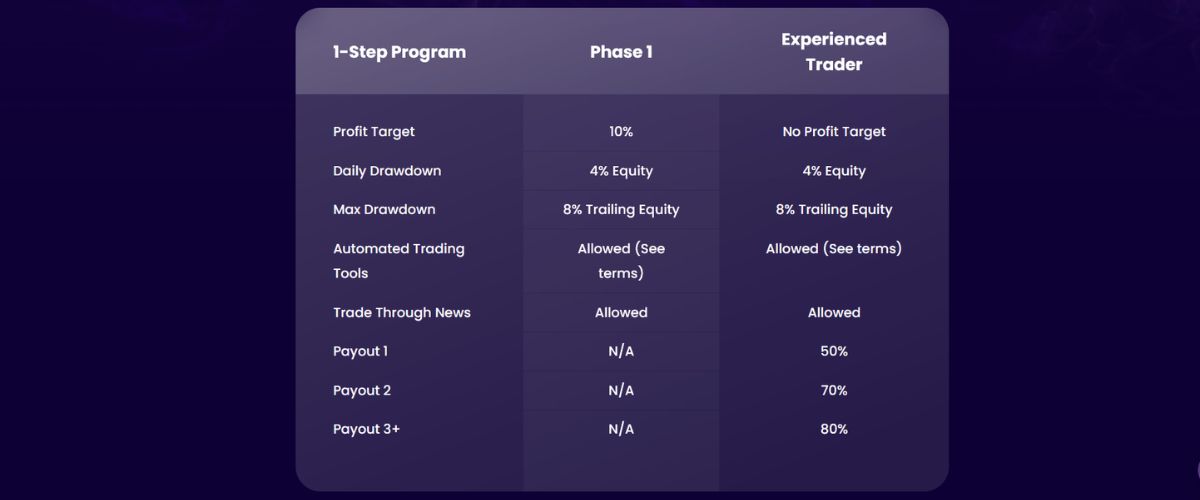

Registration and Fees: To begin the evaluation, traders must register and pay a non-refundable fee. This fee varies based on the size of the funded account they are aiming for. The cost can be a barrier for some, especially considering that failing the evaluation means losing the fee altogether.

Trading Rules and Targets: During the evaluation, traders are required to hit specific profit targets within a set period, all while avoiding excessive drawdowns. These rules are strict, and any violation, even by a small margin, results in disqualification from the evaluation process.

Funded Account: If a trader successfully completes the evaluation, they are given a funded account. Nova Funding then provides them with access to real capital, which they can use to trade. Profits generated from trading are split between the trader and the firm, typically in a ratio that favours the firm.

Reliability and Reputation

When it comes to reliability and reputation, Nova Funding has been the subject of considerable criticism. Numerous online forums and trader communities have expressed concerns regarding their practices, particularly the transparency and fairness of their evaluation process. Some traders have reported experiencing issues such as unclear communication, inconsistent rule enforcement, and delayed payouts.

Key Concerns

Lack of Transparency: Many traders have highlighted that Nova Funding’s rules and evaluation criteria are not as clear-cut as they initially appear. Some have found that they were disqualified for reasons that were not well explained or were inconsistent with what they were told upfront.

Delayed Payments: A common complaint among traders is the delay in receiving their profit payouts. Some have reported waiting weeks, or even months, to receive funds that they are entitled to according to the firm’s profit-sharing agreement.

Poor Customer Support: Several users have also pointed out that Nova Funding’s customer support is subpar. Traders often struggle to get timely responses to their queries, particularly when it comes to issues related to payments and account status.

Pros and Cons of Nova Funding

Pros

Cons

Should Real Traders Use Nova Funding?

Given the concerns and negative feedback surrounding Nova Funding, it’s worth questioning whether serious traders should consider working with this firm. While the prospect of trading with a larger capital base is enticing, the risks associated with Nova Funding may outweigh the potential benefits.

Who Might Benefit?

Experienced Traders: Those who are highly skilled and confident in their ability to meet stringent trading criteria may find value in Nova Funding’s model. However, they should be prepared for the possibility of unfair disqualification and delayed payments.

Traders with Limited Capital: For individuals who lack the personal funds to trade at a larger scale, Nova Funding offers a chance to access more capital. However, this opportunity is tempered by the significant upfront fee and the firm’s dubious reputation.

Who Should Avoid?

New or Inexperienced Traders: The strict evaluation process and high likelihood of losing the initial fee make Nova Funding a risky option for less experienced traders. They may be better served by focusing on improving their skills and building a track record before considering prop firms.

Traders Seeking Stability and Transparency: Given the numerous reports of payment delays and poor customer service, traders who prioritize transparency and reliability would likely find Nova Funding to be a frustrating and potentially costly experience.

Nova Funding – Final Verdict

In the end, Nova Funding seems to be a high-risk option for traders seeking to access additional capital. While the concept of a prop firm is appealing, the execution leaves much to be desired in this case. The strict evaluation criteria, inconsistent enforcement of rules, and payment issues raise serious red flags. For most traders, especially those who are newer to the market or seeking a reliable and transparent partner, Nova Funding may not be the best choice.

In conclusion, while the idea of trading with a larger capital base through Nova Funding can be attractive, the reality appears to be fraught with challenges and risks that may make it more trouble than it’s worth. Traders would do well to carefully consider their options and perhaps look for more reputable firms with a better track record and more favourable reviews before committing to such an arrangement.