RCG Markets is an online trading platform offering access to various financial instruments, including forex, commodities, indices, and cryptocurrencies. While the broker provides several appealing features, including access to the MetaTrader platforms, it lacks regulation by European financial authorities—a significant drawback for traders seeking stringent regulatory safeguards. However, the broker is regulated in South Africa under the Financial Sector Conduct Authority (FSCA). This regulatory framework provides some oversight, but it does not align with the more robust protections offered by European regulators like the FCA or CySEC.

Only Trade with Regulated and Reputable Brokers

| Compare Forex Brokers | Compare CFD Brokers |

This review evaluates RCG Markets’ strengths and weaknesses, focusing on its regulatory standing, offerings, and the pros and cons that traders should consider.

Regulatory Status

RCG Markets is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa. While this adds a layer of legitimacy, the FSCA’s regulatory standards are not as rigorous as those enforced by European financial authorities. Brokers regulated in jurisdictions such as the UK or the EU are subject to stricter requirements, including fund segregation, compensation schemes, and comprehensive audits to ensure operational transparency. The lack of European regulatory oversight leaves traders exposed to higher risks, particularly in areas like fund security and dispute resolution.

For traders accustomed to the stringent protections offered by European authorities, this regulatory gap is a significant concern. Many experienced traders recommend prioritizing brokers regulated by globally recognized authorities for greater peace of mind.

What Makes RCG Markets Different?

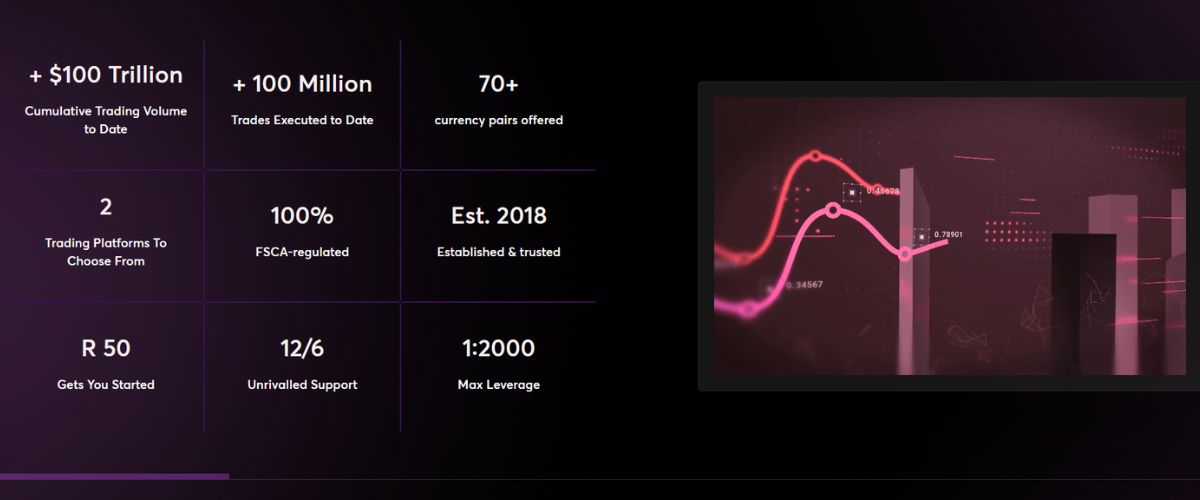

RCG Markets distinguishes itself with its wide range of trading instruments and access to popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are industry standards, known for their powerful tools, customizable features, and support for automated trading. Additionally, the broker offers various account types, including an Islamic account for swap-free trading, catering to a diverse client base.

However, RCG Markets struggles to maintain consistency in service delivery. Complaints about hidden fees, delayed withdrawals, and unreliable trade execution detract from its appeal. While the FSCA regulation offers a degree of credibility, the absence of European oversight and the operational challenges reported by users make RCG Markets a less attractive option for risk-averse traders.

What RCG Markets Has to Offer

Trading Platforms: RCG Markets provides access to MT4 and MT5, platforms renowned for their advanced charting tools, technical indicators, and algorithmic trading capabilities. While these platforms are reliable and widely used, the broker’s proprietary platform has faced criticism for being less intuitive and prone to connectivity issues, potentially frustrating users during high-pressure trading situations.

Account Types: The broker offers several account options, including Standard, Premium, and Islamic accounts. These accounts are designed to cater to different levels of trading experience and requirements. However, the lack of transparent information about spreads, leverage, and fees creates uncertainty for potential clients. For instance, Standard account holders face wider spreads, while Premium accounts, though advertised as cost-effective, often incur hidden commissions.

Range of Instruments: The broker supports trading across forex pairs, commodities, indices, and cryptocurrencies, providing traders with opportunities to diversify their portfolios. However, reports of slippage and delayed executions during volatile market conditions raise questions about the broker’s reliability. These issues are particularly concerning for high-frequency traders and those using scalping strategies.

Educational Resources: RCG Markets’ educational resources are limited to basic guides and introductory content. These resources are inadequate for advanced traders seeking in-depth analysis, expert insights, or interactive learning tools like webinars and workshops.

RCG Markets Pros and Cons

Pros

Cons

RCG Markets Reviews: What Traders Are Saying Online

User feedback from forums and review platforms paints a mixed picture of RCG Markets. While some traders find value in its offerings, many raise concerns about critical aspects of the broker’s operations.

- Positive Feedback: Traders appreciate the availability of MetaTrader platforms and a wide range of instruments, which support diversified trading strategies for both beginners and experienced users.

- Hidden Fees and Withdrawals: Many users express dissatisfaction with hidden fees, including inflated spreads and undisclosed commissions, as well as delays in withdrawal processing, often stretching to weeks.

- Execution Issues: Reports of slippage and inconsistent trade performance during volatile conditions suggest weaknesses in the broker’s trading infrastructure.

Overall, while the broker’s features appeal to some traders, recurring issues with fees, execution, and reliability raise questions about its suitability for professional-level trading.

RCG Markets FAQs

Conclusion: Should You Trade with RCG Markets?

RCG Markets offers a variety of trading instruments and access to industry-standard platforms like MT4 and MT5, but these strengths are overshadowed by critical shortcomings. While the broker’s FSCA regulation provides some degree of oversight, it does not compensate for the absence of stricter European regulatory standards. Issues such as hidden fees, delayed withdrawals, and inconsistent trade execution further erode confidence in the broker’s reliability.

For traders prioritizing security, transparency, and seamless execution, RCG Markets falls short of expectations. While it may appeal to those willing to take on higher risks, the consistent issues highlighted by user feedback and operational gaps suggest that potential clients should explore brokers with stronger reputations and regulatory compliance. A thorough evaluation of alternative options is strongly recommended before committing to RCG Markets.