If you’ve been around the world of trading and financial markets for any length of time, you’ll likely have come across StockTwits. A social media site aimed exclusively at the financial community, it brings together investors, traders, entrepreneurs and other stakeholders for discussions on markets, stocks and wider financial market issues.

Similar in a lot of respects to X/Twitter, it is home to an online community with a shared interest in finance, markets and trading. But how exactly does the platform work, what are the pros and cons, and is it worth being a part of if you’re looking to trade financial markets seriously?

What is StockTwits?

StockTwits is a communications and messaging platform, similar to Twitter, where users can share thoughts and opinions on different stocks, markets and trading strategies. Posts can include tickers, so everyone is on the same page as to the markets and instruments being discussed, as well as content generated by users sharing their thoughts, views and opinions.

For those actively engaged in financial markets, these discussions can be useful as a way of keeping up to date with goings on, and in forming your own opinions about how to structure your trading and investments.

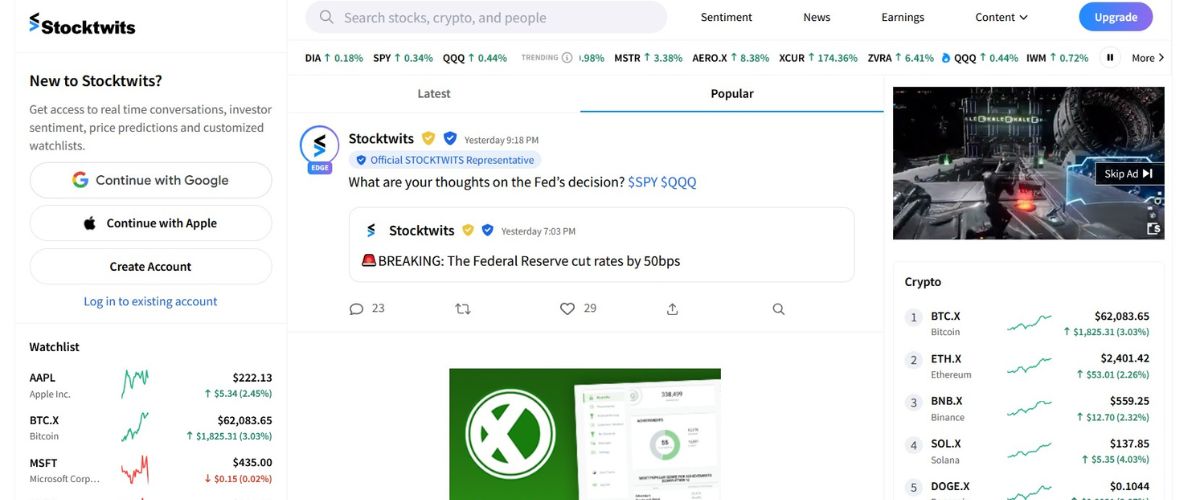

Like other social media platforms, StockTwits aggregates posts from the users you follow to create a live feed, organised around specific stocks and topics so you can dive in to learn more about what others are saying on different subjects.

Like Twitter, StockTwits can be a great source of information, especially for emerging news and breaking trends. But it also has the same limitations as any other social media platform, in that it is hard to discern valuable insight from fluff, and a general susceptibility to group-think.

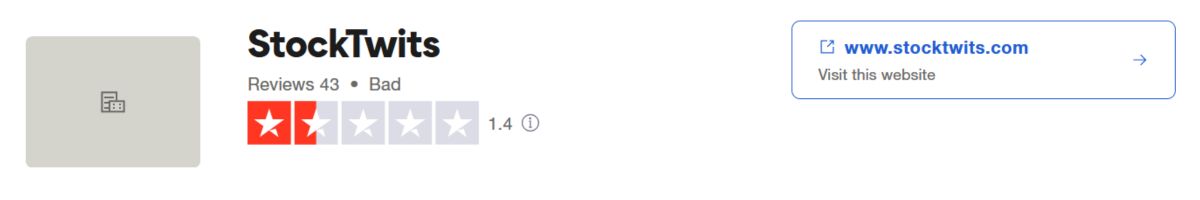

Stocktwits Reviews on Trustpilot

Still, for many traders, StockTwits clearly has value, as a popular platform used by over 6 million people worldwide.

How Does StockTwits Work?

If you’re familiar with Twitter, you’ll have no difficulty understanding how StockTwits works and how you should use it to your advantage. It starts with signing up to create an account, which gives you access to the full range of features available on the platform.

Following stocks and traders: Once you’ve set up your account, it’s time to follow stocks of interest, as well as any traders you want to keep an eye on. This helps you tailor your feed to the information you most want to see, according to your trading interests and preferences. So if you’re interested in tech stocks, for example, you can choose to follow those stocks, so updates from other users talking about these stocks will appear on your feed. Choosing specific traders is also a good move, for giving you insights into their thinking about different stocks and trading strategies.

Posting and interacting with others: It’s also possible to post your own views on different stocks, movements and trading strategies, known as “tweets”. Just like posting on Twitter, it’s a forum for you to share articles, personal insights, and your own analysis. Tagging posts with relevant tickers allows other users following the same markets and stocks as you to discover your posts, where they can engage in discussions, like, share, and even DM you if required. The platform is set up to be a place where users can help each other better understand the markets. Beyond just sharing your own ideas, it’s a place to engage in discussions, and benefit from the insights and analysis of other traders.

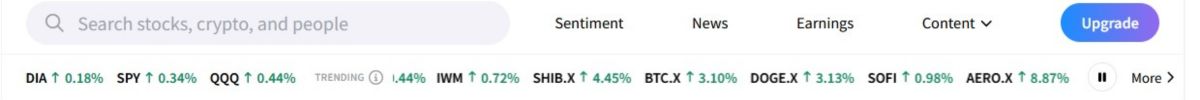

Streams and trending: Posts are aggregated together in streams, which present on your feed, or when you search for specific topics. This is a continuous flow of all relevant, tagged content. Users can also use the trending function to see at a glance the topics and markets that are gaining the most attention from the community – often a sign that there may be some significant movement underway in market sentiment or trading approach. This structure of StockTwits, similar to Twitter, makes it easy to tune in to real-time discussions on the stocks, markets and topics most of interest to you.

Sentiment analysis: Another good feature of StockTwits is at-a-glance sentiment analysis. When postings, users can declare whether they are bullish or bearish on a given stock or market. StockTwits then aggregates this data to present a snapshot of how the community is feeling the stock will perform in future – a good sign for pending reversals or confirmation of emerging trends. Again, this is only a snapshot of information, but it can be useful in conjunction with other trading strategies for determining where markets might be heading in the near future.

Charts and data: As well as the social side, StockTwits is also home to a variety of charting and data analysis tools, so you can assess different markets without having to leave the site. The charts are set up to make technical analysis straightforward, with options to show various indicators, time-frames and overlays to help in making trading decisions. With full customisation available, you can tailor the charting and analysis tools to suit your trading strategy, helping you make more informed trading decisions.

Message volume and activity tracking: High message volumes and activity on the platform could indicate a stock or a market is likely to experience a period of volatility. Higher volume could suggest increased trading intent, or the potential for upcoming news that could cause a market to move one way or another. StockTwits allows you to see this at overview level, potentially giving you a head start in making decisions.

Trending tickers: Trending tickers is another way of staying one step ahead of the market, enabling you to stay ahead of rising interest levels in given stocks and indices. When a particular ticker is trending on StockTwits, it’s usually an indication of increased levels of engagement on the platform around that ticker asset. This could either mean the asset is likely to surge in price, or fade in price, depending on the sentiment and your timing. When coupled with your own technical analysis, this can help inform the direction of your trades in the underlying markets.

Watchlists: StockTwits also allows you to set up watchlists to keep track of tickers of note, as well as receiving updates on the performance of different stocks, markets and indices. This is ideal for those managing a wider or diverse portfolio of stocks, allowing you to closely track the day-to-day performance of the stocks you’re invested in, or those that you are considering taking a position in. Watchlists are useful from an organisational point of view, helping ensure you don’t miss opportunities or red flags across your portfolio.

Direct messaging: There’s a direct messaging system built into the platform, which allows traders to reach out to other users to discuss topics of interest privately. Like DMs on other platforms, these are sent directly to a user’s mailbox on the platform, where you can explore analysis further, or discuss opportunities for collaboration and investment. This is a vital part of the networking element of StockTwits, with users able to message others on the platform to foster more personal connections.

Customizable profiles: Each user profile on StockTwits is entirely customisable, allowing you to present yourself in a professional way. From the username and profile picture to the bio, you can fully customise your profile to reflect your trading interests, style and commercial objectives. This can be especially useful for traders looking to become influencers in the financial space, with the opportunity for other users to follow and engage with your profile and your content.

Notifications and alerts: You can even set notifications and alerts for specific stocks and markets, which will alert in real-time to significant changes in the markets you’re following. Keep up to the minute with important developments happening in the markets that matter most to you, so you don’t miss changes in sentiment, news updates or major price shifts that could adversely affect your prospects.

Pros

Cons

Should Real Traders Use StockTwits?

StockTwits is clearly a useful platform, and most traders will find it helpful to tap in to the views and analysis of the trading community there. However, like all social media, it needs to be handled with caution.

It is hard to verify that the information you’re reading is of a high quality. There’s no filter for thinking on StockTwits – you could sign up today and post about a stock you think is heading for the moon, with no strong evidence to support your claims. Similarly, some users are there for self-promotion rather than to help other traders capitalise on opportunities, so you do need to take the information you read here with a pinch of salt.

Then there’s the potential for group-think. When people inhabit the same spaces and read all the same sources, it can be easy to fall into like-minded thinking – which isn’t always the best approach when it comes to trading in financial markets. Rather than moving with the herd, you want to be making trading decisions based on your own sound fundamentals. Just because users at StockTwits are bullish doesn’t mean that’s a sensible position. You still need to make your own judgments about how best you should trade.

StockTwits can be a valuable resource, but it should be one of many you use to help inform your trading decisions. In conjunction with your usual technical and fundamental analysis, it can be a good addition to the arsenal of tools at your disposal for understanding financial markets and how best to trade them.

Final Thoughts on StockTwits

StockTwits has been helping traders since 2009, providing a valuable forum for discussion, debate and analysis. With over 6 million registered users and counting, it’s one of the primary forums for discussion of stocks, indices and markets, and no doubt a useful tool for shaping your own opinions on where the markets might be heading next.

It cannot and should not be used as a substitute for your own research. But as a tool at your disposal, many traders will find it worthwhile to be part of the StockTwits community, so they can keep a finger on the pulse of what others are thinking and saying about the markets they trade.