How The Forex Funder Works and Operates

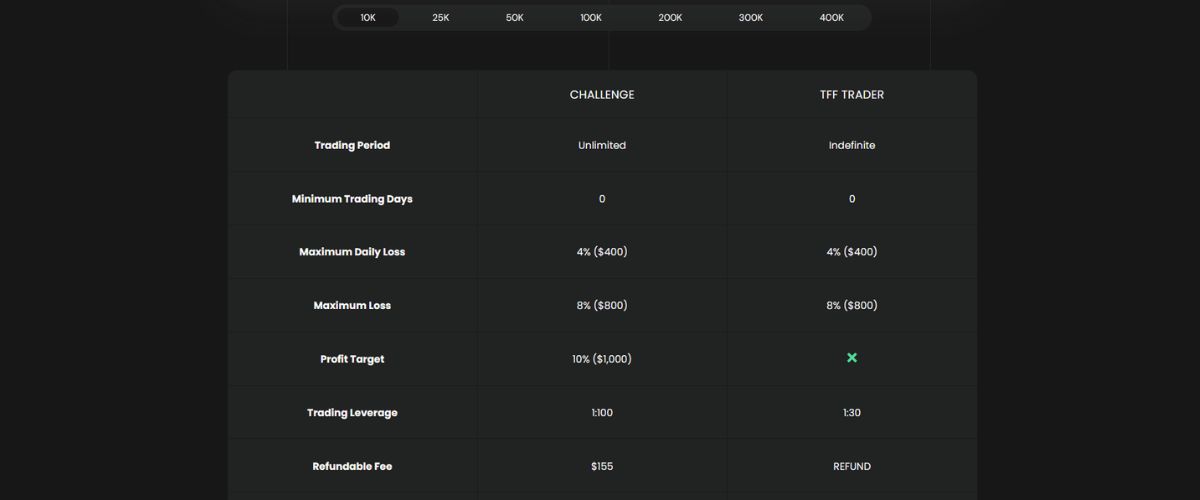

To get started with The Forex Funder, you’ll need to go through an evaluation process (there are four different types). This is their way of assessing if you’re a capable trader who can handle the firm’s capital responsibly. The evaluation begins with trading on a forex demo account, where you are required to meet strict profit targets (depending on your evaluation type), usually around 6-10%, without breaching the predefined drawdown limits. These drawdown limits, which typically range from 5-10%, are non-negotiable, meaning even a single mistake can terminate your evaluation.

Passing both phases means you’re finally “funded” and can trade with the firm’s capital on a live forex account. But even then, the rules don’t ease up. You must continue to adhere to drawdown restrictions, trading limits, and weekly profit expectations. They might also have specific rules on the maximum lot sizes you can trade or the types of currency pairs allowed. Any deviation from these rules can result in losing your funded account, even if you were otherwise profitable.

What You Can Expect When Trading with The Forex Funder

- Profit splits: Once you’re trading with real capital, you’ll be entitled to a portion of the profits you generate. Typically, you keep around 70-80%, while the firm takes the remaining cut. While this sounds generous, keep in mind that you’re the one putting in all the effort and skill.

- Monthly payouts: You’ll receive payouts on a monthly basis, assuming you’ve made profits. However, some traders report delays in receiving their earnings, so don’t expect your money to arrive instantly.

- Fee structure: There’s an upfront fee to enter the evaluation phase, which can range from $100 to $500, depending on the account size you’re aiming for. This fee is non-refundable, even if you fail the evaluation. It’s essentially a pay-to-play model, and the costs can add up quickly if you don’t pass on your first attempt.