Unregulated Broker, Be Cautious When Trading with Trader’s Way

Trader’s Way, founded in 2011, is an online broker that offers access to various markets, including forex, cryptocurrencies, commodities, and indices. Despite being in the industry for over a decade, Trader’s Way remains an unregulated broker, which is a significant red flag for many traders. While it promises a range of trading accounts, high leverage, and various platforms, the lack of regulation and some questionable aspects of its offerings make this broker a less-than-ideal choice for traders seeking security and transparency.

Only Trade with Regulated and Reputable Brokers

| Top Rated Forex Brokers | Best CFD Brokers Compared |

The website itself is quite basic and outdated, lacking the polish you might expect from a broker that has been around for this long. For many, this might signal a lack of investment in user experience, which could be reflective of deeper issues. Given the broker’s unregulated status, it’s essential to weigh the risks before committing any funds to this platform.

What Makes Trader’s Way Different?

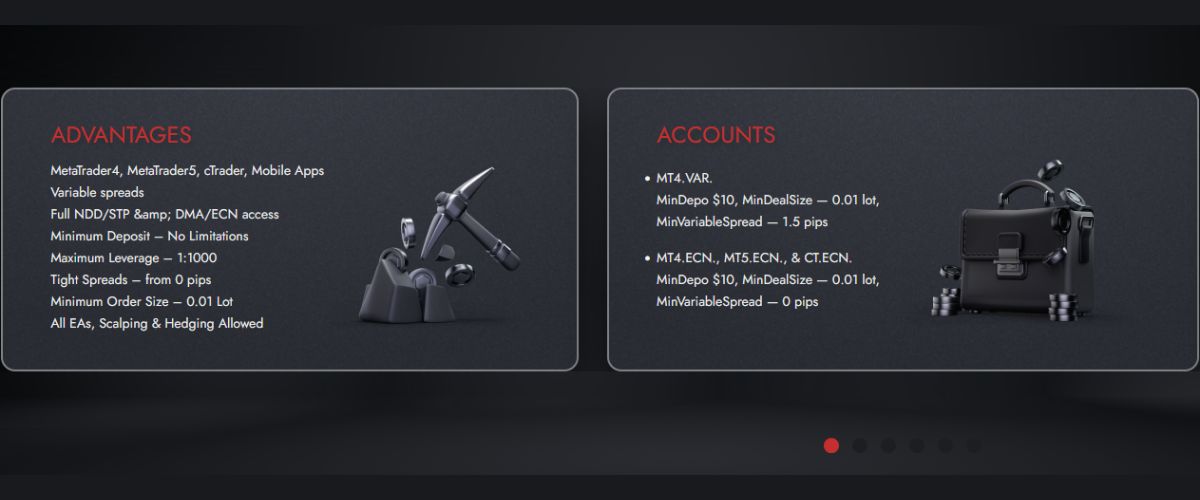

Trader’s Way stands out, primarily due to its unregulated nature, which allows it to offer high leverage levels and seemingly more flexible trading conditions than you might find with regulated brokers. For some high-risk traders, the allure of leverage as high as 1:1000 is enough to catch their attention. However, this kind of leverage can be incredibly risky, amplifying both gains and losses in ways that can wipe out accounts just as quickly as they can boost them.

Another feature that sets Trader’s Way apart is the range of platforms it offers, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are popular in the trading community, known for their advanced charting tools and customizable interface. But despite offering these trusted platforms, the broker’s overall experience feels underdeveloped, with a website that lacks sophistication and professionalism.

Additionally, Trader’s Way allows deposits in cryptocurrencies, which can be a convenient option for some traders. However, while crypto deposits might be a modern touch, they don’t compensate for the more pressing concerns related to the broker’s overall reliability and the potential risks involved in using an unregulated platform.

What Trader’s Way Brings to the Table: The Full Offering

Trading Platforms: One of the few redeeming qualities of Trader’s Way is its access to some of the industry’s best-known trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Both MT4 and MT5 are widely respected for their powerful charting tools, technical indicators, and automated trading capabilities, making them suitable for traders with a range of experience levels. The inclusion of cTrader is also a plus, as this platform offers a modern interface and faster execution speeds, particularly appealing to those who engage in scalping or high-frequency trading.

While the range of platforms is a positive feature, the overall user experience is undermined by the outdated and bare-bones design of the Trader’s Way website. Navigating through the site feels like stepping back in time, which doesn’t inspire confidence in the broker’s commitment to keeping up with industry standards. A polished, professional website is often a sign that a broker values transparency and user experience – neither of which are evident here.

Account Types: Trader’s Way offers four different account types, each designed to suit various trading preferences. The MT4.FIX Account comes with fixed spreads starting from 2.0 pips and no commission charges, making it suitable for traders who prefer predictability in their trading costs. However, the wider spreads may not appeal to those who prioritize tight pricing. The MT4.VAR Account offers variable spreads starting from 0.7 pips, which fluctuate based on market conditions, allowing for potentially lower trading costs during periods of low volatility, but with the risk of spreads widening during high volatility.

For more experienced traders, the MT4.ECN Account provides spreads starting from 0.0 pips, combined with a $2.50 commission per $100,000 traded. This account is ideal for traders who prefer the tightest spreads and are comfortable paying a commission for more favourable trading conditions. The cTrader ECN Account mirrors the MT4.ECN Account but comes with a slightly lower commission rate of $2 per $100,000 traded. Both ECN accounts cater to high-frequency and professional traders seeking optimal trading costs and faster execution speeds, making them attractive options for those willing to trade in larger volumes.

Range of Instruments: Trader’s Way gives its clients access to a variety of trading instruments, including over 40 forex pairs, cryptocurrencies, commodities, indices, and metals. While this range isn’t as extensive as what you might find with larger brokers, it does provide enough variety for most traders looking to diversify their portfolios. However, the limited selection of forex pairs and other assets might be a disadvantage for those who want access to a wider range of markets.

Despite the broker offering various instruments, it’s hard to overlook the fact that these come without the protections typically provided by regulation. Traders should be cautious about investing in these markets with a broker that lacks oversight, as it increases the risk of unfair trading conditions or even financial loss.

Fees and Spreads: Trader’s Way’s fee structure depends on the account type, with tighter spreads available on the ECN accounts in exchange for commission-based pricing. The spreads on the MT4.VAR and MT4.FIX accounts are wider but commission-free, making them less attractive to active traders who prioritize low trading costs.

The broker claims to offer competitive spreads, but it’s crucial to remember that without regulation, there’s little assurance that these fees will remain fair. Traders could face hidden charges or increased costs that aren’t explicitly disclosed upfront, a risk that regulated brokers tend to mitigate by adhering to stricter guidelines.

Deposit and Withdrawal Options: Trader’s Way offers various deposit options, including cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. This is a modern feature that appeals to those who prefer to handle their funds in digital currency. In addition, more traditional deposit methods, like bank transfers and credit cards, are also available.

While the availability of cryptocurrency deposits is a plus, it doesn’t offset the more significant concerns about the broker’s lack of regulation. Traders should be wary of funding their accounts with large sums, as there is little recourse available if something goes wrong. Cryptocurrencies, in particular, offer limited protections when it comes to disputes or fraud.

Customer Support and Educational Resources: Trader’s Way offers customer support via live chat, email, and a contact form on its website, available 24/5. While these support channels are standard, the overall service quality leaves much to be desired. The website’s basic design doesn’t inspire confidence in the professionalism of their support team, and traders seeking quick or in-depth assistance may be left disappointed.

In terms of educational resources, Trader’s Way provides minimal materials. The educational section on the website is basic, offering only a handful of tutorials and guides, which are far less comprehensive than what you would expect from a broker in operation for over a decade. This lack of investment in education indicates that the broker may not prioritize helping traders develop their skills, a major disadvantage for beginners.

Trader’s Way Pros and Cons

Pros

Cons

What Are Traders Saying About Trader’s Way?

When browsing various forums and review platforms, such as Forex Peace Army and TrustPilot, the feedback on Trader’s Way is mixed at best. On Forex Peace Army, many traders express concern about the broker’s unregulated status, with several warning others to approach the platform with caution. The lack of oversight from a recognized financial authority remains a major sticking point for many users, especially those who have had previous negative experiences with unregulated brokers.

User Quickly on forexfactory.xom: “It seems completely weird that anyone doing any due diligence at all could actually choose to trade there.”

User Dr Conner on forexpeacearmy.com: “I would like to share my experience with tradersway. In general, my impression of it can be characterized as neutral, without any pronounced positive or negative emotions.”

On TrustPilot, the broker garners an average rating, with some users praising the high leverage options and availability of platforms like MT4, MT5, and cTrader. However, numerous traders criticize the outdated and basic design of the website, noting that it doesn’t inspire much confidence in the broker’s professionalism. Additionally, while some traders appreciate the ability to deposit in cryptocurrencies, the overall user experience seems to leave much to be desired.

Trader’s Way FAQs

Final Verdict: Should You Trade with Trader’s Way?

Trader’s Way’s access to popular trading platforms and high leverage options may appeal to experienced traders who understand the risks involved. However, the broker’s unregulated status, outdated website, and lack of educational resources make it hard to recommend, particularly for those who prioritize safety, transparency, and user experience.

Without the security that comes with regulation, trading with Trader’s Way involves significant risks. For traders who want peace of mind and a more modern, user-friendly experience, there are better-regulated alternatives in the market that offer far more in terms of protection, reliability, and support.