Established in 2001, ActivTrades is a CFD and Forex broker situated in London, renowned for its emphasis on customer-focused services and ability to provide traders access to a wide range of financial markets. Since the broker has been in business for more than 20 years, traders from all over the globe have come to rely on it. Strict regulatory scrutiny from organisations such as the UK Financial Conduct Authority, the Securities Commission of The Bahamas, and CMVM in Portugal is a crucial differentiator for ActivTrades from its rivals. ActivTrades has established itself as a major participant in the trading industry, with offices across Europe, Asia, and South America.

Offering a wide variety of cutting-edge trading platforms, a plethora of trading products, and completive spreads, ActivTrades is a fully licensed broker. Notwithstanding its extensive array of features, the broker does present many noteworthy shortcomings, including inactivity fees and restricted assistance for copy trading. We will examine all of ActivTrades’ key features, advantages, disadvantages, and client feedback as we go further into this review.

Broker

Markets

Platforms

Open Account

70% of retail investors lose money when trading CFDs with this provider

Notable Benefits

What Makes ActivTrades Different?

ActivTrades stands apart from the competition due to its cutting-edge technology, personalised services, and impressive regulatory background. Its investment in creating its own trading platforms and tools has been consistent throughout the years, and it has improved the trading experience for its customers.

The broker stands apart from the competition because of its suite of patented add-ons, which automate and streamline trading processes. Traders can automate stop-loss or take-profit levels, execute trades more rapidly, and simplify the trading process overall with the aid of these tools. Though MT4 and MT5 are both extensively used and industry-standard platforms, ActivTrades gives its traders an advantage in the fiercely competitive financial markets by integrating its unique tools into these platforms.

Traders who reach ActivTrades’ volume thresholds are also eligible for free VPS hosting. Automated traders will find this feature very useful since it provides a more stable trading environment with reduced latency, which is especially important in times of market volatility.

Customer service, education, and platform features have all garnered accolades for the broker. This recognition attest to ActivTrades’ dedication to leading the trading industry in innovation and quality. Though accolades are a good indicator of a broker’s quality, it is important to remember that many other brokers provide essentially the same platforms and services.

What ActivTrades Has to Offer

ActivTrades provides a wide range of services for traders of all skill levels. Here is a detailed overview of the main features:

Trading Platforms

ActivTrades provides the well-known MetaTrader 4 and MetaTrader 5 in addition to its proprietary ActivTrader platform. Let’s look more closely at each of these:

Account Types

For traders of different experience levels, ActivTrades offers a range of accounts:

ActivTrades offers an account type to meet the needs of each trader, from beginners just starting to seasoned experts in need of additional leverage and features.

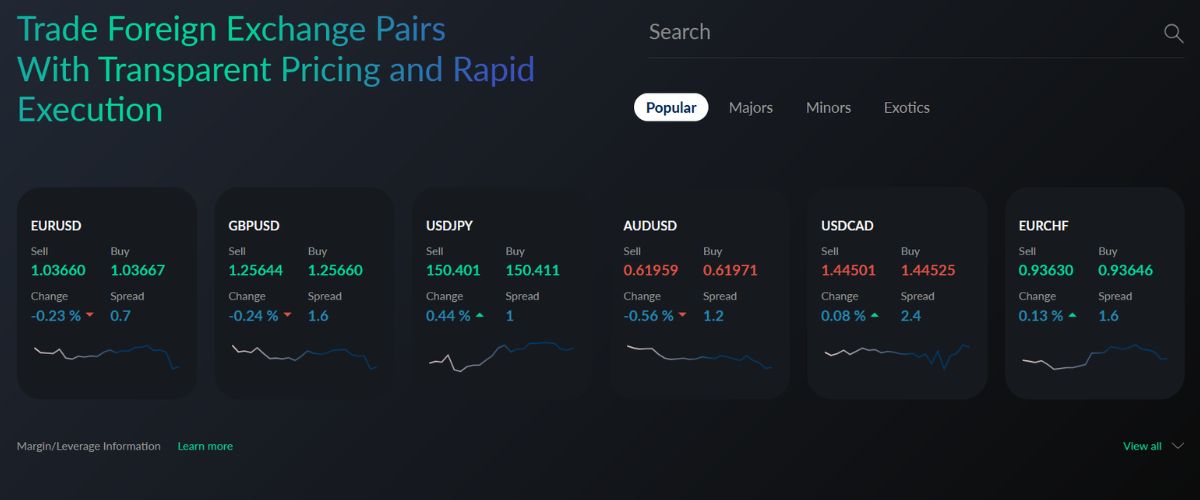

Trading Instruments

ActivTrades lets buyers buy and sell a lot of different assets on the market. You can now buy from the following markets:

Fees and Spreads

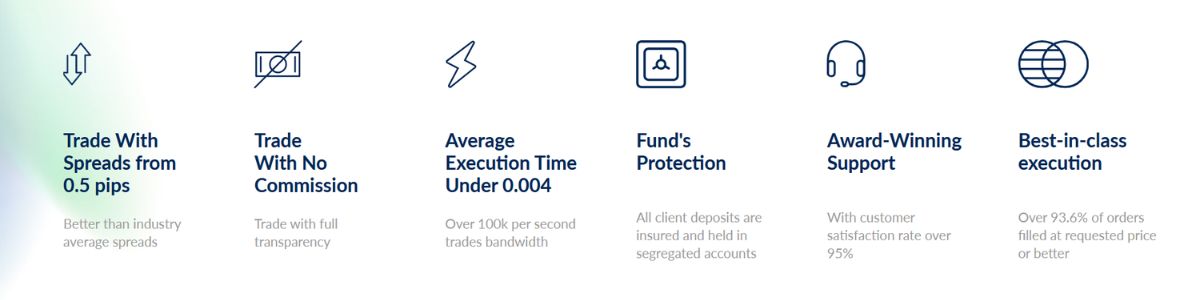

There are times when the spread for the well-known pairs of currencies, like EUR/USD, can be as low as 0.5 pip. When you trade on an index, the spread starts at 0.5 points.

One of the best things about ActivTrades is that it has simple fees. Most accounts do not have any secret fees, and the exchange rates for overnight amounts are easy to see. One downside is the broker’s “€10 inactivity fee”, which kicks in after 18 months of no trade on an account. This could be a problem for those who do not trade very often or who take long breaks from the markets.

Deposit and Withdrawal Options

ActivTrades offers a variety of deposit and withdrawal options, including – bank transfers, credit and debit cards, and e-wallets such as Skrill and Neteller. The procedure is generally straightforward, and the majority of deposits are evident immediately. Nevertheless, the processing of withdrawals may require up to two business days, contingent upon the procedure.

Although the majority of deposits and withdrawals are fee-free, 1.5% charge for credit/debit card deposits and a £9 fee for bank transfer withdrawals apply.

Customer Support and Educational Resources

ActivTrades provides multilingual customer care by live chat, email, and phone, which are available around the clock. The broker’s client service has received positive ratings for its quickness and knowledge. During periods of strong market activity, reaction times may lag.

In terms of learning resources, ActivTrades offers a comprehensive learning centre that covers everything from webinars and tutorials to market research and trading strategies. Traders of all experience levels may benefit from these tools, which are available in a number of languages and help them stay current on market trends and skill development.

ActivTrades Pros and Cons

Pros

Cons

ActivTrades Reviews from the Internet

ActivTrades Reviews on Trustpilot

User Drolph on forexfactory.com: “I am trading with them for about 8 month now. All good so far. Professionell support, no execution issues, no requoting so far. Withdrawing works as well.”

User pip2hunt on babypips.com: “I traded there for quite some time. Lately however all swap is changed to fees only. Even pairs that at most brokers pay swap refund. They updated their terms few weeks ago with specifically extra text about swap. Better avoid this broker”

User Oleg on quora.com: “Not very often, if I’m being honest to you. Maybe it’s not very obvious to those who are beginners in the forex market. But ActivTrades from the first approach creates an impression of a credible forex broker. It’s not some kind of a biased opinion because I’m not even a client of this company. Although I’m thinking about becoming one, I genuinely am.”

User recklessloving on reddit.com: “Also one of the few brokers that allow you trade live/directly on TradingView (which is why I use them). Still only rockin demo accounts as I am still learning, but yeah. So far, so good.”

ActivTrades FAQs

ActivTrades – Final Thoughts

ActivTrades is a dependable and strong broker that provides a safe trading environment, low fees, and cutting-edge technology. Its range of platforms, tools, and instructional materials suits both new and experienced traders. The broker is especially appealing to big-volume traders and automated strategy users because of its narrow spreads and free VPS hosting.

However, some people may find that the lack of copy trading and the inactivity fines are deal-breakers. Overall, ActivTrades sticks out as a reliable option in the competitive field of online trading for traders who value security, regulation, and platform flexibility.