City Index is one of the longest-standing brokers in the trading industry, with a history dating back to 1983. Over the years, it has built a strong reputation as a multi-asset brokerage, offering traders access to a diverse range of markets and professional-grade tools. Owned by StoneX Group, a NASDAQ-listed financial powerhouse, City Index is recognised for its transparency, regulation, and reliability.

The broker operates under strict financial oversight from some of the most respected regulators in the industry, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS), and Cyprus, Canada, UK, Hong Kong, Japan, Cayman Islands. These regulatory bodies ensure that City Index adheres to high financial and operational standards, providing traders with security and trust when using its services.

City Index offers access to over 13,500 markets, including forex, indices, commodities, shares, options, and Thematic Indices. This makes it one of the most versatile brokers available, catering to both retail and professional traders. However, how does it compare to other major brokers in the industry? This review will examine its features, fees, market offerings, and user experience to help traders determine whether City Index is the right fit for their needs.

Broker

Markets

Platforms

Open Account

71% of retail investors lose money when trading CFDs with this provider

Notable Benefits

What Sets City Index Apart?

City Index is known for providing traders with a comprehensive trading experience, offering a range of account types, thousands of tradable instruments, competitive fees, multiple trading platforms, and strong support services. In this section, we will break down the broker’s offerings in detail.

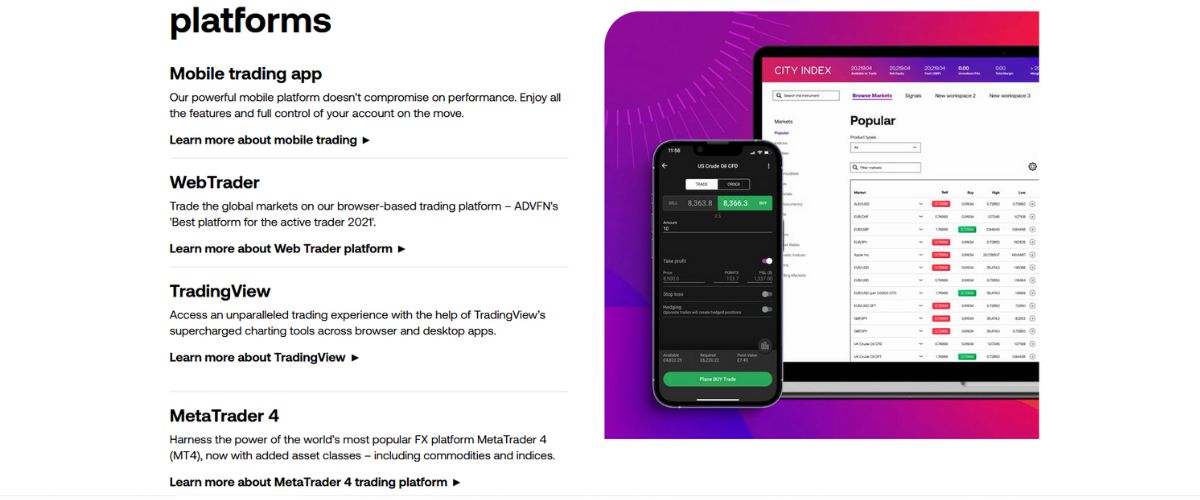

Trading Platforms

City Index offers three distinct trading platforms, catering to different types of traders. Whether you prefer advanced technical analysis, algorithmic trading, or a user-friendly web interface, City Index ensures there is a suitable platform for every trader:

Each of these platforms offers unique advantages, giving traders the flexibility to choose the one that best suits their trading needs and experience level. Whether using MT4 for automated trading, Advantage Web for simplicity and research integration, or TradingView for advanced charting, City Index ensures that traders have access to a professional and reliable trading environment.

Account Types

City Index provides multiple account types, each designed to suit different levels of experience and trading preferences.

Range of Trading Instruments

City Index offers an impressive selection of over 13,500 tradable instruments, making it one of the most diversified brokers in the industry. Traders can choose from a wide variety of asset classes, including:

No Cryptocurrency Trading for UK Retail Clients – Due to FCA regulations, City Index does not offer cryptocurrency trading for retail traders in the UK.

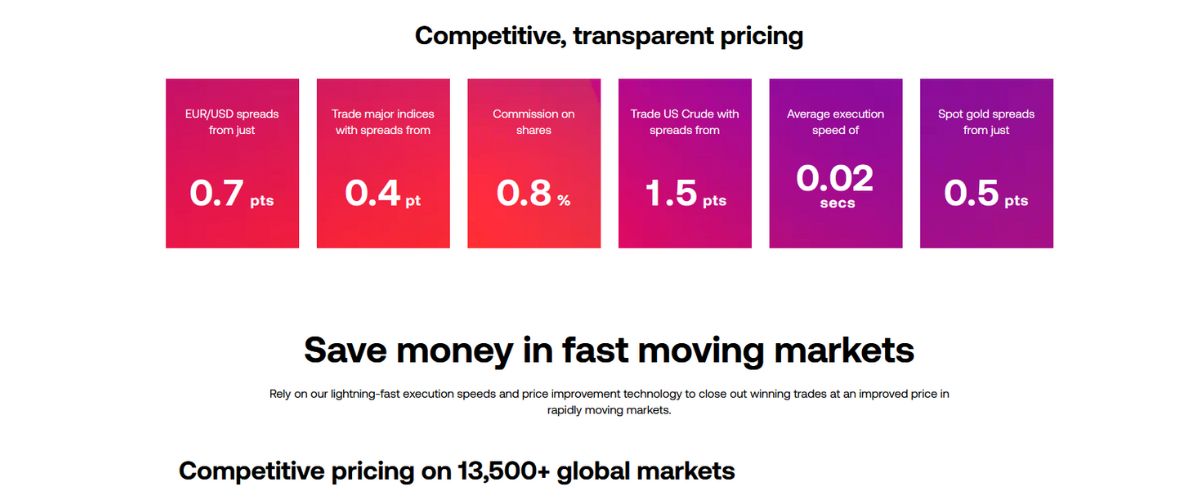

Fees and Spreads

City Index is highly competitive in terms of pricing, offering low spreads and commission-free trading on many asset classes. Here’s a breakdown of the fee structure:

City Index provides clear pricing information and ensures that traders understand the costs before executing trades.

Deposit & Withdrawal Options

City Index offers several payment methods, making it easy for traders to deposit and withdraw funds efficiently:

Deposits & withdrawals are fee-free, but traders should check with their banks or payment providers for any external charges.

Educational Resources

City Index also excels in trader education, providing structured learning materials for traders at all levels:

The combination of strong customer support, in-depth educational resources, and market analysis tools makes City Index an excellent choice for traders who want a well-rounded experience.

City Index Pros and Cons

Every broker has its strengths and weaknesses, and City Index is no exception. While it offers a well-regulated trading environment, a wide range of instruments, and competitive fees, there are certain areas where it falls short. Below is a detailed breakdown of City Index’s biggest advantages and drawbacks, helping traders decide whether it’s the right broker for their needs.

Pros

Cons

City Index Reviews from the Internet

City Index has received mixed reviews on Trustpilot, with many users praising its responsive customer service and efficient issue resolution, while others express frustration over login difficulties, particularly related to Cloudflare verification. Some traders appreciate the platform’s functionality and overall reliability, but concerns have been raised about deposit policies, as City Index only accepts funds from traditional bank accounts, which some find restrictive. Overall, opinions vary, with some highlighting a smooth trading experience and helpful support, while others report obstacles in accessing their accounts and funding their trades.

UK FCA Broker selection (XTB, City Index ect) (BabyPips): “I tried city index few years ago. No problem with depositing or withdrawing money but I didnt like their platform so left them. Very easy to set up and close. Customer service was good too. At the time i checked they were fca regulated for trading. You’d have to check it again.”

Barclays/CityIndex Stockbrokers for CFDs? (MoneySavingExpert): “City Index have been going for years and are reputable. They must be one of the most well known CFD / spreadbet firms in the UK. After all, if Barclays are using them as their CFD provider of choice, they’re unlikely to be some fly-by-night shysters.”

You can always find more feedback on most popular forex forums and trading communities.

City Index FAQs

City Index – The Verdict

City Index is a well-regulated and reputable broker offering a diverse range of tradable markets, competitive pricing, and multiple trading platforms. Its regulation under FCA, ASIC, MAS ensures strong financial oversight, making it a trusted choice for traders who prioritise security.

The broker stands out for its broad market selection, with access to forex, indices, stocks, commodities, and options. It also provides high-quality research tools, advanced charting platforms, and educational resources, making it suitable for both new and experienced traders. However, the absence of MetaTrader 5 (MT5), copy trading features, and cryptocurrency trading for UK retail clients may limit its appeal for some.

Overall, City Index is a solid option for traders looking for a well-established broker with strong research tools and a wide range of markets. While it may not be the best fit for those seeking social trading or crypto exposure, it remains a reliable choice for traders who value regulation, research, and platform flexibility.