Pepperstone is an online financial spread betting, CFD and forex broker, headquartered in Australia. Founded in 2010, it has garnered a reputation for slim spreads, streamlined deposits and withdrawals, and support for a wide range of CFD and forex markets. The fees are generally low across the board at Pepperstone, with the exception of overnight financing on some CFDs, which can cost a bit. For forex traders, the fees and spreads are super low, one of the main draws of Pepperstone as a broker.

While comparable to a number of other well-known brokers, it does have some limitations – a limited number of markets to trade so it’s not an ideal broker if you want to trade exotic shares. Their interface could also do with some work, losing out to some more advanced offerings from their rivals. But on balance, Pepperstone is a broker that still has merit, and comes highly recommended for spread betting, CFD and forex traders.

Trading Instruments at Pepperstone

Pepperstone specialises in CFDs, spread betting and forex markets, with a selection of trading markets that will meet the needs of the vast majority of investors. CFDs and spread bets are available on a range of underlying assets including commodities, indices, shares and forex. There are even CFDs available on cryptocurrencies, offering an alternative mechanism for speculating on crypto price movements. Aside from overnight financing costs for some assets, which can be a little higher than normal, Pepperstone has developed a reputation for offering low trading costs in general – an appealing offer for traders across the board.

Trading is supported by MetaTrader, one of the more widely used interfaces for trading financial markets. While it’s not everyone’s cup of tea, it will be a familiar interface for most experienced traders, who will no doubt have come across it before. With a good selection of trading instruments available with low fees in general, it’s a tempting prospect for those considering trading with Pepperstone.

Pepperstone Platforms, Charting Tools and Execution

Charting tools are available at Pepperstone through the desktop trading platform, powered by MetaTrader. There is also the option to trade via cTrader if you prefer, though support for MetaTrader 4 and 5 will be adequate for the needs of most traders. This provides a familiar trading interface on both desktop and mobile, via the MetaTrader app, so you can manage your trades on the move.

The interface at the Pepperstone website does leave some room for improvement, and it’s definitely not as slick as some of the other high-end brokers we’ve seen. But it’s a small suggestion for a broker that is otherwise pretty decent across the board, and particularly effective where it counts – in delivering low cost access to the key financial markets you want to trade.

Order execution is quick and easy, a theme that runs in general through the Pepperstone experience. From a user perspective, it’s a pretty good offering for Pepperstone customers.

Pepperstone Mobile Apps

Pepperstone is available via the MetaTrader mobile app, which we’d recommend as your option for trading on mobile. There’s also a Pepperstone app you can download to your device for free, which allows you to manage your account through the Pepperstone interface. While this is still a good way to manage your account on mobile, the functionality available with the MetaTrader and cTrader apps is better suited to the needs of more advanced traders.

The Pepperstone app itself is decent enough, with similar limitations to the Pepperstone web trading platform. On the whole, the mobile experience is acceptable, including via your phone browser, where you can access and login to your account as you would on your desktop device.

Accounts and Fees

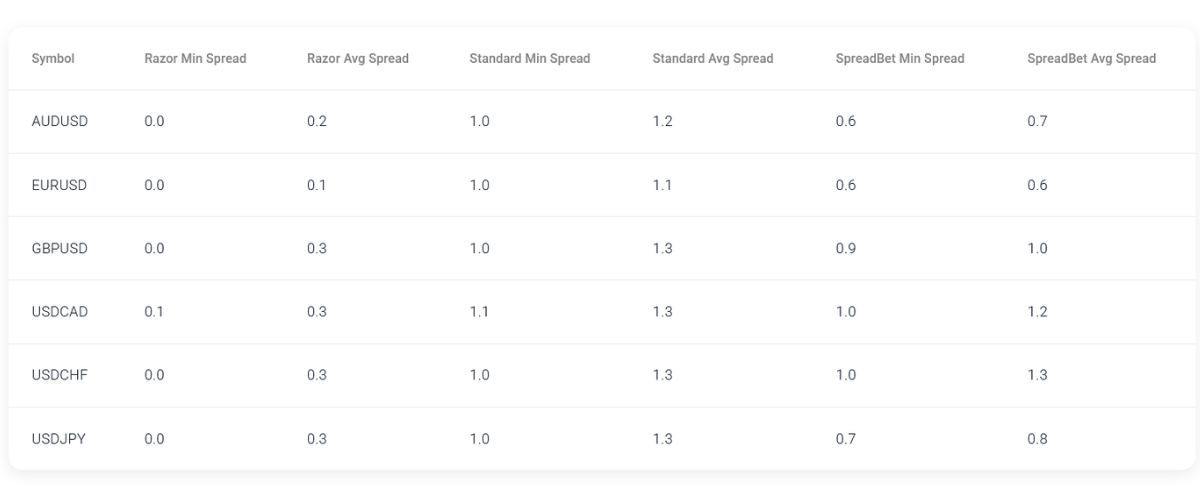

Pepperstone offers ultra low spreads on forex markets

Arguably one of the best features of Pepperstone is its low spreads and fees, which are generally towards the lower end of the spectrum. The exception to the rule is overnight financing, which can be expensive depending on the underlying asset.

Forex spreads are generally low, and there is no withdrawal fee or inactivity fee applicable to your account balances with Pepperstone. Spreads are tight as a rule too, making this an inexpensive platform to trade compared to some of its competitors.

Deposits and Withdrawals

There’s no fee for depositing to your Pepperstone account, with a multitude of payment methods available for you to choose from, including support for debit card payments. A selection of 10 base currencies is available for you to deposit into your account, giving you plenty of options for funding your capital balance. It’s also possible to deposit by PayPal, for convenient, secure funding; withdrawals are equally straightforward and secure.

Trust and Reputation

Trust is one area where Pepperstone has it completely covered. While it’s not part of a larger banking group or a publicly traded company, it is regulated in 7 major financial markets, including by authorities in the UK, Germany and Australia. Maintaining compliance with 7 different regulators is no mean feat, and it’s a credit to the way Pepperstone runs their operation that they are able to remain in good standing with all of these regulators. From a trust point of view, this is a major green flag. Investor protections guaranteed by regulators in the different countries in which Pepperstone operates means you can be assured of safeguards for your funds in the event the company becomes insolvent.

Pepperstone Pros and Cons

Pros

Cons

Pepperstone Reviews from the Internet

Pepperstone Reviews on TrustPilot

User SA_Trends on forexpeacearmy.com “I have continuously written them emails (I have like more than 50 emails) and the only thing they can say is that is not in their hands and the money have been sent to tue intermediary bank. After 4 months they are unable to provide me a MT103 Trace Message that could help me to understand where my money are.”

User MarcRaffard on forexfactory.com: for my point of view, Pepperstone is a quite good broker! (I worked 10 years on the FX industry at FXCM, OANDA, FIXI, JFD Brokers… so I know the industry). If you choose Pepperstone, the Razor Account is the best option. The spread on EUR/USD is good and commission are competitive.

User chesterjohn on babypips.com: “I use Pepperstone on a spread betting account. No complaints. Withdrawals arrive without fuss and fca regulated.”

User LGcowboy on reddit.com: “As average as any broker. I’d say account management is ok, they don’t really contact you or share anything relevant. Customer service is average. Spread isn’t as good as they state unless you exclusively trade majors. One type of account is commission free but 1 pip more in spread.”

Pepperstone FAQs

Pepperstone – The Verdict

Pepperstone is a perfectly respectable broker, with a number of good things going for it. The low forex spreads, for example, are a major draw for traders looking to speculate on financial markets. So too is the selection of major markets on offer, which cover a wide range of different markets and indices, providing a leveraged trading instrument for capitalising on even slight movements in the assets you’re trading.

The banking function is easy enough, with plenty of methods for deposit and withdrawal, including support for PayPal for maximum convenience and security. Both deposits and withdrawals are processed quickly too, so you won’t find yourself waiting forever to get your hands on your withdrawn funds.

The overnight financing charges can get expensive on some instruments. The interface is somewhat limited compared to some other brokers, and there could be more in the way of trading resources and information to help new traders. MetaTrader 4 and 5 support is decent, but it would be good to see Pepperstone onboard more different options for its trading platform. And it would be nice to be reassured that Pepperstone is on a sound financial footing, perhaps by seeing public financial statements, which it currently doesn’t publish.

But on balance, Pepperstone does perform well in our review. This is a broker we can recommend without major hesitation, one we know is a secure, honest and low-cost option for trading financial markets. Whether you’re looking for spread betting, forex or CFD trading, Pepperstone is well worth further investigation.