Spreadex is a UK-regulated trading company, offering access to spread betting, CFDs and forex with low fees and slim spreads. Founded in 1999 by former trader, Jonathan Hufford, it made its name in offering spread betting, before diversifying to offer some other trading instruments. Not as broad in scope as some other brokers, Spreadex tends to be an ideal choice for those looking at spread betting and CFDs specifically, rather than those looking for a broker to trade in other markets and derivatives.

Trading Instruments at Spreadex

Trading is easy through the web and mobile interface, which is fairly self-explanatory and designed to be used by traders of all levels of experience. While there is no stand-alone desktop trading platform as such, the Spreadex interface is streamlined enough on both web and mobile trading for the majority of traders.

Spreadex Interface, Charting Tools, and Order Execution

Advanced charting tools are part of the offering at Spreadex, both through their web and mobile interface. You choose to trade via charts, a range of drawing tools, tick-by-tick intervals and a host of other features, with templates you can use and customise to fit with your trading strategy. With price alerts, advanced orders and watchlist tools amongst others, there is plenty in the way of technical support to equip traders with the resources they need to execute a range of strategies.

Order execution is generally smooth and quick, even in times of high volatility and lower liquidity. Generally considered on the faster end of the spectrum for execution, Spreadex customers benefit from a lower market risk than with some other brokers when entering and exiting their positions.

It’s hard to fault Spreadex on the technical side. Everything they offer is easy enough to use, even for those still finding their feet with trading fundamentals, while providing the tools intermediate and more experienced traders need to make informed decisions about their trading.

Spreadex Mobile Apps

Spreadex has a range of apps available for traders who like to manage their positions on-the-go. Apple and Android users can benefit from apps that are free to download and install, offering a simple, intuitive interface for trading and monitoring your positions. The apps are encrypted by SSL for cutting edge levels of security, fast execution, price alerts and advanced charting software all built into the apps as standard.

Spreadex has gone all out with its apps, making them some of the best we’ve seen from a UK broker. Everything you could want as a retail trader is contained within the apps, all offering a native experience to your mobile device for the most streamlined trading interface available on mobile.

Alternatively, you can also login to your trading account on mobile via your device browser – an equally suitable option for traders who prefer not to download the app, or who want to login periodically to check the progress of their trades.

Accounts and Fees

One of the things Spreadex has become known for is its low fees – both trading and non-trading. There are low fees for trading forex, and no fees at all for inactivity. Again, this is something you often find across a number of leading brokers, where a charge will be levied for periods of inactivity on any balance within your account. At Spreadex, fees are only charged when you trade.

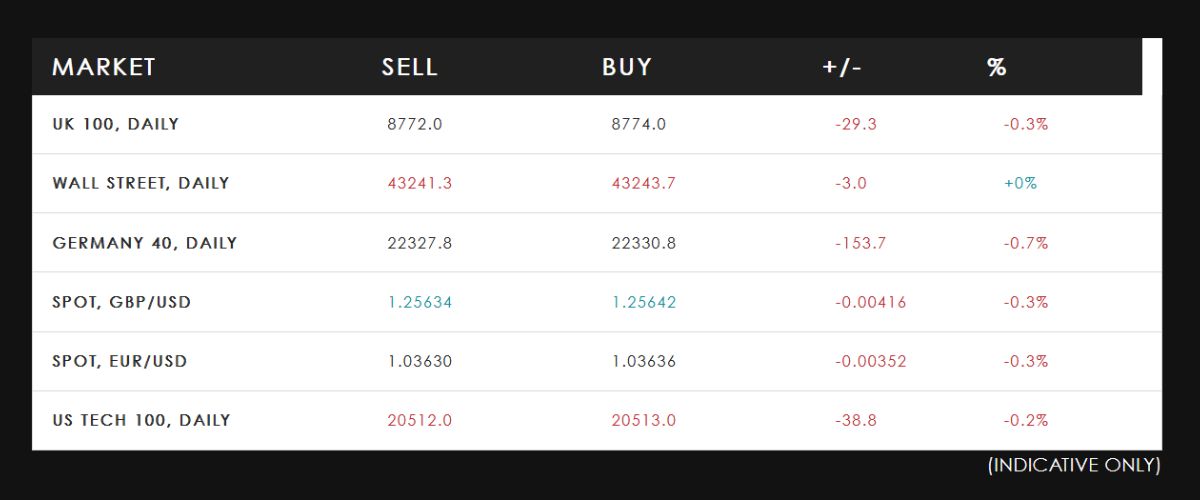

Spreadex Spreads and Markets

On the CFDs side, the fees can be slightly higher, but by no means outside the realms of average for brokers of this scale. Generally, trading with Spreadex feels like a low-ish fee experience, which is one of the reasons they remain such a popular choice for traders nearly 25 years after they were established.

Deposits and Withdrawals

With no minimum deposit amount and fast withdrawals across the board, Spreadex is top in class on the banking side. The lack of a minimum deposit means it’s possible to set up your account right away without committing initial capital – you can decide to deposit at a later date through one of the many supported payment methods, including debit card and direct bank transfer.

There is a minimum withdrawal amount of £50, though this is reasonable enough given the lack of deposit minimums. Withdrawals are processed quickly and can be with you in a matter of hours for most payment methods. At worst, you can expect to wait between 2-5 days to receive cleared funds in your account, in cases where your bank is not set up to receive the funds faster.

All in, the depositing and withdrawal experience at Spreadex feels pretty seamless – a major advantage of choosing Spreadex as your CFD broker or spread betting company.

Trust and Reputation

Trust is all important in a broker – with Spreadex, you can sleep easy in the knowledge that this is one of the leading names in the UK scene. Having been around since 1999, they continue to attract new customers while holding on to the old guard – testament to the trust and reputation they’ve built up in the market over the past 25 years.

As a fully compliant and FCA regulated broker, Spreadex has the highest levels of regulatory compliance possible for a UK broker. This means they operate entirely within UK laws, including consumer protection laws for retail customers, for that added sense of security. With full encryption on their website and mobile apps to protect your personal and financial data, Spreadex is a safe, secure and trusted place to conduct your trading business.

Spreadex Pros and Cons

Pros

Cons

Spreadex Reviews from the Internet

Spreadex Reviews on TrustPilot

User Spread-Bettor on trade2win.com: “As others said before me, as a spread betting broker they are alright but the spreads are not very competitive.”

User Matt H on forexpeacearmy.com: “Really good website, the spreads arent the best you can get, but great customer service and simple platform with great executions. Not had any problems with them.”

User Pauley1 on babypips.com: “I’ve had a browse and have opened an account with Spreadex”

User xana96 on reddit.com: “Spreadex i have been using, their customer service is decent and not had any major issues but a couple of things to watch for (bear in mind i’m a recent newbie so these might be general spread betting issues rather than SpreadEx, i don’t know).”

Spreadex FAQs

Spreadex – The Verdict

Spreadex is by no means the perfect broker. There are a few areas where they could improve, but to be honest, they’re unlikely to cause too much trouble for most traders. On the positive side, their low fees, acceptable range of markets and inviting web interface and trading tools make it a joy to trade on their platform.

Fast withdrawals are another advantage here, as is the lack of a deposit minimum, which gives you the ultimate flexibility in how you manage your funds. With slim spreads across most of its markets, plus the experience of some 25 years in business, you can be confident choosing Spreadex for spread betting, CFDs and forex trading.

A solid platform for beginner to intermediate traders, Spreadex has a lot of strengths. While some more advanced traders might start to run into some limitations, there’s a reason Spreadex have been so successful over the past quarter of a century. With their highly trusted name, strong customer support function and generally smooth trading environment, there’s a lot to like about what Spreadex has to offer. A highly recommended choice from us for those looking to find the right broker.