Trade Nation is an award-winning broker offering low-cost trading, tight fixed spreads and a simple, intuitive trading platform. Since its launch back in 2014, Trade Nation has grown to become the go-to choice for traders looking for a no-nonsense, gimmick-free platform that does exactly what it says on the tin.

Regulated by authorities in the UK, Australia, South Africa and the Bahamas, its multi-instrument trading platform allows access to forex, CFDs and financial spread betting markets – all within a single portal, with support for MetaTrader4 for more advanced traders.

Formerly known as Core Spreads which started as a purely spread betting broker, Trade Nation has been winning over fans as a trusted, reputable place to trade, with tight fixed spreads, easy payments and solid customer service.

Broker

Markets

Platforms

Open Account

73% of retail investors lose money when trading CFDs with this provider

Notable Benefits

Trading Instruments at Trade Nation

Trade Nation is home to over 600 tradable markets, between forex, shares, commodities, and markets. There are 35 forex pairs listed for trading on the Trade Nation platform, along with hundreds of share markets between the US, the UK, Europe and South Africa equities – more than enough to cover most active trading strategies. Crypto trading is also available to users who are covered by the Bahamas license, allowing access to trading in crypto derivatives for non-UK residents.

When signing up with Trade Nation, traders can choose between CFD and spread betting to suit their strategy and preference, giving a full range of options for trading. Ideally suited to new traders, in large part thanks to its straightforward trading platform and complementary education materials, Trade Nation is a popular choice for traders signing up for their first account.

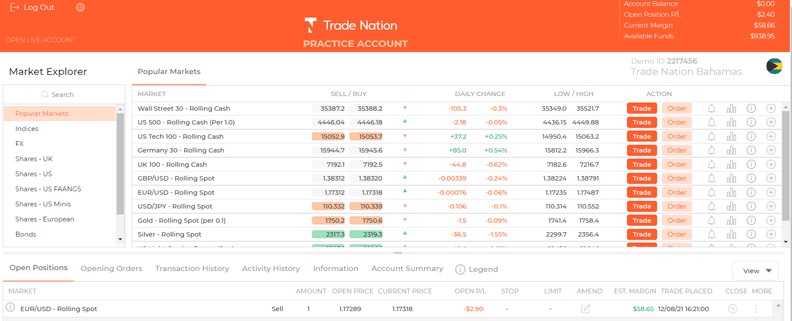

Trade Nation Interface, Charting Tools and Execution

Amongst the best features of Trade Nation is its simple user interface, which makes it easy for traders to execute trading decisions and monitor the markets. This is pitched perfectly for new traders, who can often feel overwhelmed with more complex trading platforms and features. Setting alerts, opening charts and placing orders is all intuitive, making it easy to do the basics of successful trading from within the Trade Nation platform.

Charting is delivered with the help of ChartIQ, one of the leading charting tools in the market. Some 95 different indicators are available, along with 35 drawing tools to give you full flexibility on interpreting price data across the markets you trade. With the help of trading signals powered by Acuity in the Signal Centre, there is a good suite of tools to help traders to make the right calls.

More advanced traders with a clearer idea of their strategy and trading technique may find the Trade Nation platform a little limiting. This is definitely more directly aimed at those with less experience, and there are some key elements more established traders would expect that are missing here. Things like advanced charting and news tracking, which more veteran traders would expect, have been left out for simplicity.

Overall, the platform is decent, especially for those new to the world of financial trading. Whether you’re using it to trade forex, CFDs or for financial spread betting, Trade Nation offers a strong suite of tools to help you get the job done.

Trade Nation Mobile Apps

Apps are available for free for iOS and Android users. You can download and install these to your device in a matter of seconds and be up and running with your same account credentials on your mobile device. The trading platform on mobile is equally as easy to use, such that it’s perfectly possible to manage your trades and research positions on the go.

Charting tools are also available when you trade via the mobile apps, including trend lines and multiple time frames, so you still get the information you need when you’re analysing markets on mobile.

Watchlists and alerts are also still available through the mobile apps, which offer an almost perfect equivalent of the online platform. Traders who rely on MetaTrader 4 can also use this platform for mobile trading.

Accounts and Fees

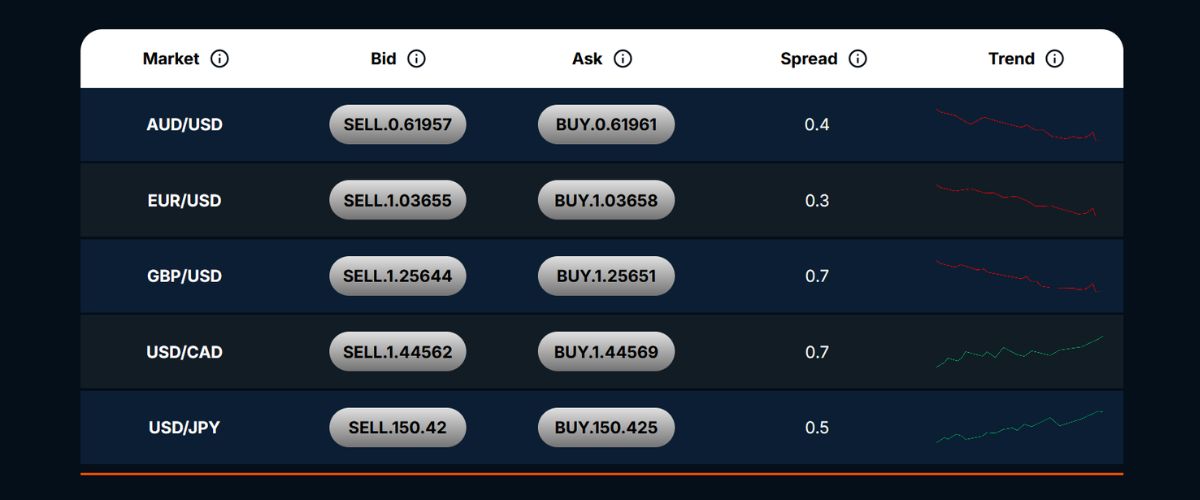

Trade Nation offers fixed spreads, which limits the need for calculating price when entering and exiting markets. Most brokers use variable spreads – but through the Trade Nation platform, you know what you’re getting in terms of trade price before you enter the transaction. Please note, fixed spreads are only available on TN Trader.

The exception to the rule here is in the rollover period, where fixed spreads temporarily widen. This takes spreads of 0.6 pips up to as much as 1.4 pips during the rollover period, though this typically lasts about an hour.

Trade Nation Spreads and Markets

As commission and fees go, Trade Nation is generally good value for money compared to other brokers. This makes life easier for traders, who have less of a hurdle to overcome in every trade to exit in profit.

Deposits and Withdrawals

Trade Nation supports several different deposit and withdrawal methods, making it easy to move money to and from your account. There is no minimum deposit required to open an account – get started from $0 by registering your details. When it’s time to deposit your funds, you can choose between Visa, MasterCard, Bank Transfer and Skrill.

A minimum withdrawal amount of $50 or equivalent applies, and withdrawals can take 1 to 5 business days to reach your account. In order to withdraw, you may be required to verify your identity in line with KYC processes – a standard requirement across the industry. Make sure to complete this as soon as possible to avoid delays at the withdrawal stage.

Deposits and withdrawals tend to be relatively smooth at Trade Nation. For the most part, there will be no difficulties in moving money to and from your Trade Nation account.

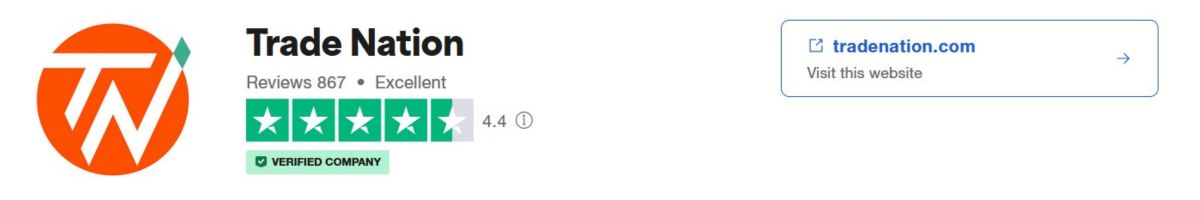

Trust and Reputation

With around a decade serving the needs of traders worldwide, Trade Nation ranks highly on the trust factor. Licences from financial regulators in the UK, Australia, South Africa and the Bahamas means Trade Nation is facing compliance across multiple different fronts – a good sign for traders who want to ensure they’re dealing with a competent, legitimate outfit.

Their reputation is long-standing, thanks to a track record of serving the needs of their customers. In the highly competitive broker market, it’s not possible to survive for long without meeting the needs of investors – something Trade Nation has been doing year on year since 2014.

Their platform relies on cutting edge security, including the latest in SSL encryption to protect login, trade and financial information, protecting against fraud and theft for a safe, secure experience. From a trust standpoint, Trade Nation is right up there as one of the most secure trading platforms on the market.

Trade Nation Pros and Cons

Pros

Cons

Trade Nation Reviews from the Internet

Trade Nation Reviews on TrustPilot

Let’s start off the review with what real people have to say about Trade Nation:

- User ProfessorPips on babypips.com: “low cost trading, fast execution, good customer service, wide deposit methods, education section, just be a partner in business.”

- User BigDeal on trade2win.com: “As a client of Trade Nation for leveraged trading I am disappointed to see they’ve increased their spreads on CFDs and Spreadbets. They’ve been pretty competitive up until now and it’s a good time to shop around I guess. However they are still one of the only fixed spread providers out there I think.”

- User justV_2077 on reddit.com: “Trade Nation has a wonderful day trading simulator. They teach you the basics there and you can also check if your decisions would end up with profit or loss.”

Trade Nation FAQs

Trade Nation – The Verdict

Trade Nation has been winning over new traders at an impressive rate, hence its growth as a platform over the past 10 years or so. Ideally positioned for those new to CFDs and forex trading, it offers the right combination of user-friendliness and functionality. While the most experienced traders will tend to prefer platforms with more advanced functionality, Trade Nation does an excellent job for the vast majority of those trading in financial markets.

Support for MetaTrader 4 is a bonus, and the charting and analysis tools that are present are enough for the majority of trading strategies. While there’s room to develop on the analysis and education side, Trade Nation knows its market, and offers a comprehensive platform for those getting involved in trading for the first time.

A good platform for beginner and intermediate traders with a trusted reputation, we have no hesitation in recommending Trade Nation as an ideal broker for spread betting, CFDs, and forex trading.