Quarterly bets are used by longer-term traders, looking to spread bet on developments within markets over a period of several months. Traders taking quarterly positions will broadly be trading on broader signals, with a view to capitalising on significant changes in a market over the lifetime of the trade. With quarterly bets as opposed to rolling daily spread bets or other forms of exposure, the costs of financing the position are built into the commission computation, and as such are a critical factor in determining overall profit and loss. This makes it important to understand how quarterly bets work, and how they can be used to the benefit of your spread betting account.

Longer-term strategies aren’t traditionally seen as the best approach to spread betting, but that doesn’t have to make them impossible to implement. In fact, for those that utilise the full palette of trading tools available to them in trading over longer time frames, there are benefits to be had in terms of the ease of the transactions and the outcomes that can be delivered. One such way of using all the available options is through trading quarterly bets, which are designed to give traders a means to speculate on positions with a longer-term projection.

Quarterly bets have unique features of their own that make them distinct, and these are each worthy of further analysis in order to unlock the true potential of quarterly bets. For any strategy looking to mid to long-term market shifts, trading quarterly bets can be a more cost effective, straightforward way to achieve this end.

What Are Quarterly Bets

With quarterly bets however, the settlement comes at the end of the trade. In some instances this might be a positive (for example, where positions don’t initially move in the anticipated quarterly trend direction). Either way, it remains important to calculate your liability for financing these positions so you know where you stand as the trade approaches its end game.

Quarterly Bet Advantages

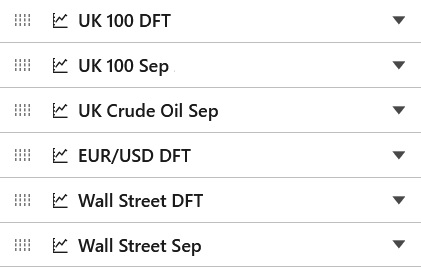

Quarterly bets offer traders an effective mechanism for taking long term spread betting exposure. By taking quarterly positions, traders can effectively short-cut having to trade through over the period, and can do so in a more cost effective manner as far as overnight financing costs are concerned. They can be taken on a wide range of markets and spread betting bases to allow longer term speculation with all the regular benefits of financial spread betting as the trading vehicle.

Quarterly Bet Disadvantages

One of the main disadvantages associated with spread betting quarterly bets is that the spread is often considerably wider than with the rolling daily bets. This makes trading quarterly positions more expensive in the first instance, so UK day traders are generally better off with daily rolling bets for short term positions. Furthermore, quarterly bets are priced at a premium (or a discount) to reflect market sentiment as to where prices might go in future, often having a dampening effect on the profitability of quarterly bets.

How to Use Quarterly Bets to Best Effect

Quarterly bets are more effectively used for trades over a number of weeks right up to the three month timeframe for which they stand. Generally, for these longer term positions quarterly bets do represent a cost efficient way of trading the market, particularly given the scope for successful positions to run on earning money for months. Quarterly bets are most effectively deployed in conjunction with thorough research and assessment of markets and where they might be heading in the near to mid future.